Adopting the Higher for Longer

1 March 2023

Contagion and Containment – SVB23

13 March 2023RISK INSIGHT • 7 MARCH 2023

What next for Central Banks?

Marc Cogliatti, Head of Capital Markets EMEA

Three weeks ago, I highlighted that central banks across the globe may be forced to keep rates higher for longer given the secondary risks to inflation arising from higher wages and embedded inflation expectations. At the time, I was thinking about what this might mean for growth. However, as these risks become more pronounced, an arguably more important factor to consider is what will happen if central banks choose to become more tolerant towards higher prices. Rather than keeping rates higher for longer, or even tightening policy further to bring inflation down to the 2% target rate most central banks have adopted in recent years, what would happen if they decided to accept higher inflation and shift their target rate to 3-4% instead?

Addressing the issue in the FT, former Bank of England Chief Economist, Andy Haldane, called for central banks to adopt a more flexible approach. Higher prices, he explained, are a result of dislocations in global supply chains, buffeted by geopolitical crosswinds. The end of the golden age of globalisation, and the fact that it will take a long time for supply chains to be repaired, mean that the traditional approach to dealing with inflation will not have the desired effect this time around.

In his opinion, sticking with rigid inflation targets will either result in them being continuously missed (assuming the central banks do not tighten enough) or it will unnecessarily damage any green shoots of growth (if they continue to raise rates). Instead, he proposes a more flexible approach involving either transparently lengthening the horizon upon which inflation will be expected to return to target or, more radically, temporarily suspending the target all together and pledging to reinstate it at the earliest possible future date.

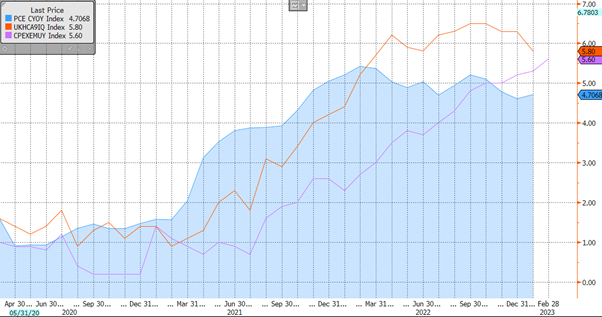

Chart 1: Core inflation across the US (blue), Europe (purple), and the UK (orange) has shown little sign of abating in recent months.

Source: Bloomberg

While this sounds like a relatively sensible approach, it raises two issues. First and foremost, if the markets sense that central banks are losing control, this will likely lead to a sharp rise in volatility, particularly in the rates and FX markets. Although the cause was different, the market reaction to the fiscal policies of former UK Prime Minister Liz Truss’ government is a good example of what can happen in a stressed market environment. In terms of direct impact, the cost of borrowing rose sharply for anyone with debt while the volatility resulted in a loss of confidence across the investor spectrum. Secondly, if central banks give the impression that they will tolerate inflation, even if it is just in the short term, higher prices will prevail – triggered by supply and demand-side factors alike. This would make it even more difficult to bring inflation back under control further down the line.

Chart 2: The cost of borrowing for 10y shot up dramatically in the UK last September as the Liz Truss budget rocked market confidence.

Source: Bloomberg

From a markets perspective, while central banks will keep short-term rates low, the longer end of the curve will rise sharply as markets price in an increased risk premium and higher rates further out. Volatility in FX markets is also likely to rise sharply, particularly if different central banks adopt different policies. For example, if the Bank of England temporarily suspends its inflation target while the European Central Bank elects to stand firm, the pound will almost certainly come under heavy pressure against the euro. If all the major central banks adopt a similar approach, it might lessen the extreme directional bias, but increased volatility will likely prevail nonetheless.

Ultimately, it feels like there is no easy way out. While looser monetary policy may ease some of the pain in the very short-term, the longer-term consequences are potentially even more troublesome and damaging than the situation we currently find ourselves in.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.