Markets Price the Pivot on Interest Rates

3 February 2023

It’s grim, but not as bad as we were told it would be…

15 February 2023INSIGHT • 7 FEBRUARY 2023

The 49th Parallel Divide

Kambiz Kazemi, Chief Investment Officer

The US non-farm payroll number released on Friday, February 3 shocked market participants by vastly beating all estimates—coming in at 517,000 versus the average estimate of 188,000. The market promptly priced more than one additional rate hike (29bps) by July 2023, which matches the 5.1% terminal median rate for Fed Funds projected in the Fed’s December Summary of Economic Projections. Unsurprisingly, the US dollar also marched 2% higher from its recent low on February 1.

With the market digesting and repricing this surprise, we want to take a closer look at Canada, where employment numbers for January are due later this week on Friday, February 10.

Despite the move in the US short-term curve, the reaction in Canada’s short end remains relatively muted pricing only another ½ rate hike to the end of this cycle; expected to be in summer of 2023.

In our view, the BoC’s decision to signal a pause in the hiking cycle at its last meeting was wise. Despite their geographical proximity and interconnected economies, Canada and the US face different risks (see, for example, Hiking Risks and Canada and US - diverging policies, diverging economies).

The BoC appears aware of the many risks facing the Canadian economy—i.e., consumer pressure, a declining housing market and the cost of debt—and has acted accordingly.

Yet the road ahead presents a complex combination of risks.

The consumer is under pressure

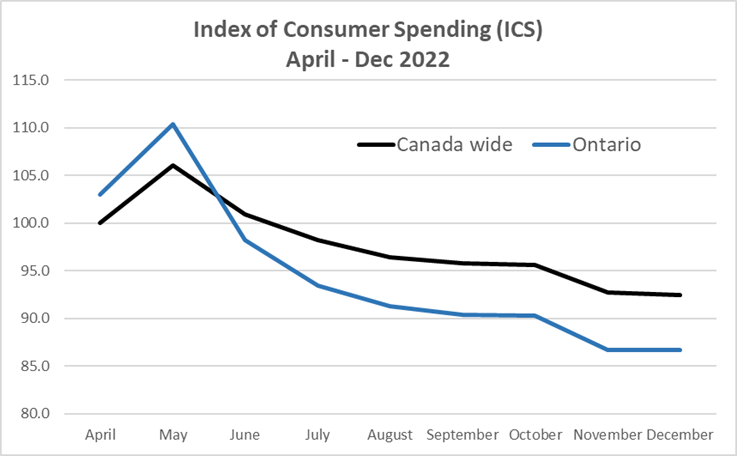

Following its most recent hike on January 25, the BoC stated that “consumption growth has moderated from the first half of 2022”, and the Index of Consumer Spending (ICS) produced by the Conference Board of Canada depicts a very dim picture of consumption. This index offers the advantage of being transaction based and high frequency (weekly data).

Nationwide, December 2022’s ICS is 8% lower than in April 2022. In Ontario, however, the number has dropped over 13% in the same period. This is particularly alarming as Ontario is Canada’s most populous province and contributes 38% of national GDP. Moreover, Canadian household leverage continues to remain very high with a debt to disposable income ratio of 1.84x, far exceeding that of the US at 1.0x.

It is likely that households have adjusted their consumption patterns lower as a result of the higher cost of servicing their debt—an adjustment that has not run its course and warrants close monitoring.

Chart 1: Index of consumer spending (ICS)

Source: Conference Board of Canada

A declining housing market

In the same statement, the BoC also highlighted that “housing market activity has declined substantially”. The construction industry has been a driving force and important contributor to economic activity in Canada, representing 7.5% of GDP (versus 3.9% in the US) and employing over 7% of the Canadian workforce (versus 4.8% in the US).

According to the Teranet-National Bank House Price Index, house prices in Canada peaked around May 2022 (right after the start of the hiking cycle) and were down 11% from the peak at the end of December. In Ontario, the biggest market by size, the correction was around 20%.

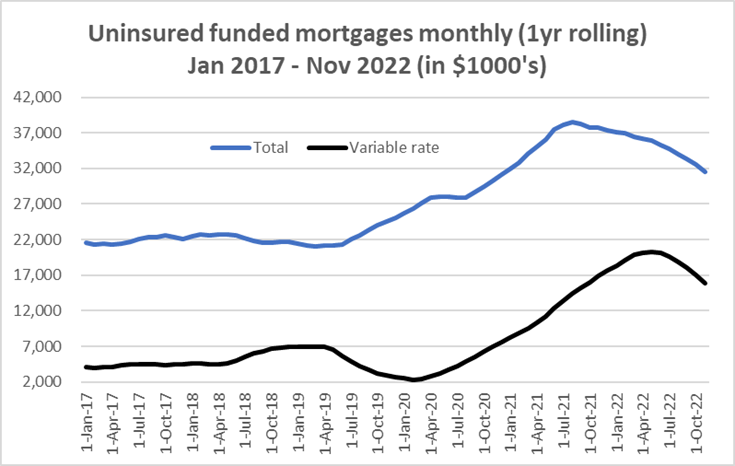

Chart 2: Uninsured funded mortgages monthly (1yr rolling)

Source: Bank of Canada

Meanwhile, mortgage funding has dropped by 20% for variable rate mortgages since April 2022. Even more concerning, variable mortgage issuance rose by 80% in the prior year to April 2022 at a time when market valuations were on the rise and mortgage rates were heading near historic lows. A combination of leverage from high valuations and financing risk due to rate variability has exposed many homeowners to a new kind of risk.

Cost of debt risk

The full extent of the risk posed to leveraged home owners by the increase in the cost of debt has yet to fully emerge. As variable rates move higher, fixed mortgage payments can end up being insufficient to cover the interest payments, thus reaching the ‘trigger rate”. At that point, homeowners can face one of many scenarios. For instance:

- The lender asks them to increase the value of their mortgage installments.

- The lender offers to temporarily extend the amortisation period to as long as 40 years (from the usual 20 to 25 years) to “help”. In reality, this simply “kicks the can down the road”, further delaying any problems.

- The lender could also offer reverse amortization – which means adding the portion of unpaid interest exceeding the installments to the outstanding mortgage loan value. The homeowner would thus pay interest on interest, while waiting for lower rates to arrive.

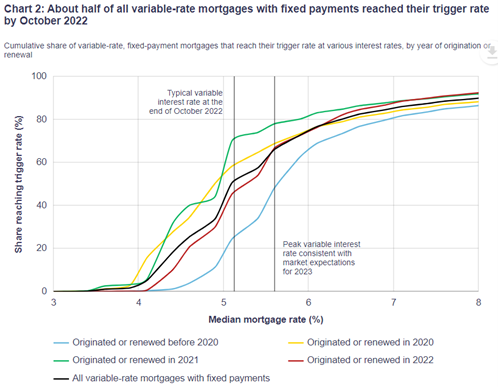

How substantial is the trigger risk?

Analysis from the BoC estimates that nearly 50% of variable rate mortgage rates had reached their trigger by October 2022. Since then, interest rates have risen further. By end of Q1 2023, we estimate nearly 80% of all variable rate mortgages with fixed payment could reach their trigger.

A natural consequence is that households will likely change their behavior on aggregate – even if they choose not to increase their mortgage installments—among other things by being more consumption conscious. This, in turn, can add to the risk of an economic slowdown.

Chart 3: Cumulative share of variable-rate, fixed-payment mortgages

Source: Bank of Canada

Conclusion

The silver lining in the Canadian story is a – to date – healthy job market. Despite the increasing burden of the cost of debt, a healthy job market provides households with the ability to face this challenge by changing their financial priorities and habits. But the road ahead is uncertain and remains a particularly treacherous one for the BoC to navigate. Striking the perfect balance between tightening economic conditions and not damaging the job market is a very narrow rope that the BoC must walk along—a much more precarious set-up than Canada’s southern neighbor who does not face this housing and debt problem to the same extent.

The coming months will be key. Investors should monitor closely the indicators we covered in this note to appraise if Canada will weather these risks.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.