The gloves are off, but for how long?

1 July 2022

Tax cuts, spending and regime change: key risks in the Tory leadership race

12 July 2022INSIGHT • 5 JULY 2022

The (inflation) shock is over, back to normal?

Kambiz Kazemi, Chief Investment Officer

“Markets could be facing a scenario where transitory inflation is subsiding and partly behind us. In that case, the Fed’s late and blind insistence to fight will have undesirable effects for 2023.”

The changes we have observed across markets in the last two weeks of June are as impressive as some of those we witnessed since the start of the pandemic.

Chart 1: Sharp correction in commodity prices in June 2022

Source: Bloomberg

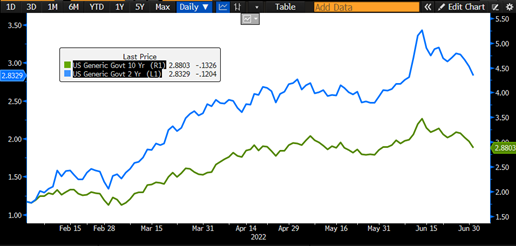

Commodities have corrected sharply with wheat and corn coming nearly back to their level prior to the illegal invasion of Ukraine, while crude oil has dropped nearly 15% from its early June highs. While part of this retracement might be ascribed to a perception of tensions easing or market participants getting accustomed to the war in Ukraine, the story is not limited to Russia/Ukraine-linked commodities. Copper, often viewed as a gauge of industrial health and activity, was off 20% in June and US 2-year and 10-year yields have had massive reversals of 50 to 60bps which are as abrupt as the pace of their rise earlier in the year.

Chart 2: Sharp reversal of US interest rates

Source: Bloomberg

What are these recent drastic price moves signaling?

The retracement in commodities seem to be in part due to a perception that some of the related risk emanating from the war in Ukraine has dissipated on the one hand and, the fact that sanctions on Russia are not necessarily as effective as some expected.

Russia oil exports continue as the demand in the Asian market (albeit at discounted prices) has replaced the void of demand due to European sanctions. The willingness of Russia to allow the flow and export of grains has also reduced perceived risk with regards agricultural commodities. However, as long as sea freight from southern Ukraine is not fully established, price pressures will remain. Additionally, the uncertainty around future harvest remains real.

Generally, it seems market participants have now incorporated the conflict as part of their reaction function and the perceived unwillingness of both parties to massively escalate has provided some reprieve to the commodity crunch.

But the war in Ukraine hardly explains the astonishing drop in US short and long-term rates over the last two weeks. There is increasing talk and pundits voice concerns over a recessionary scenario or that of stagflation in 2023. Fed Chair Powell himself recognized such risk in his testimony to Congress on June 22nd, saying it was “certainly a possibility.”

Rate cuts coming in the spring of 2023?

In fact, we sit at a very paradoxical juncture, on the one hand the Fed keeps the narrative of the inflation well alive and strongly reaffirms its willingness to continue raising aggressively, at the time of writing pricing a full 0.50% hike in July and 80% probability of a 0.75% – all while acknowledging the risk of recession in the very near term.

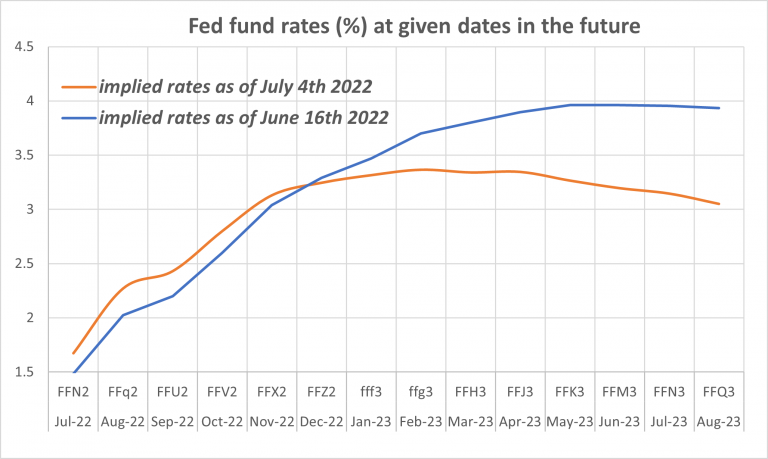

Chart 3 is a great illustration of this conundrum as is shows the expectations of where Fed funds are expected to be at future dates. On June 16th, the market saw continued rate hikes into early 2023 with overnight rates stabilizing at 4% thereafter, but only two weeks later it sees overnight rates at only about 3.25% by year-end and starts pricing rate cuts in the spring of 2023! What an astonishing change in expectations in a matter of weeks.

Chart 3: from rate hikes to rate cuts in 2023

Source: Bloomberg

While the recession and/or hard landing views have gained momentum, in our opinion another scenario is increasingly plausible and likely. The Fed might have stepped up not only too late but too much. In fact, throughout 2021, we saw inflation as an important risk while the Fed insisted on its transitory nature, maybe hoping that it will subside and thus they will not have to act.

There is no doubt that inflation is in part transitory, but in our view, there are also seminal inflationary forces. However, what if the transitory portion of inflation has already peaked or is about to and the Fed is pressing hard on the pedal after we are through the danger? The price behaviors we highlighted for commodities and rates could be an indicator of such softening of the transitory portion of inflation.

If that is the case, there is probability – we see it as 50 to 60% – we would witness this summer softer data on inflation, starting with US CPI on July 13th followed by PPI and PCE later that month.

What happens if investor price out “aggressive” rate hikes?

As a result, investors might start pricing out some of the “aggressivity” of rate hikes by the Fed further bringing down the orange curve in Chart 3. If this were to happen, some of the immediate consequences could be:

- Constructive for risk assets, in particular equities which after having suffered a rout would welcome less aggressive tightening policy. Interest rate-sensitive (growth) stocks will likely be the main beneficiaries.

- A weakening of US dollar as hikes are priced out, although some jurisdictions such as the ECB will still be playing catch up.

- A stabilization of longer-term rates. Albeit, continued Quantitative Tightening (QT) will continue to provide upside pressure to long-term rates.

In summary, markets might be facing a scenario where transitory inflation is subsiding and partly behind us. In that scenario, the Fed’s further and blind insistence to fight already-dissipating inflation will have undesirable effects for 2023, whereas a change in their narrative and hawkishness might well help markets and the economy weather (at least in part) the upcoming storm of slower growth.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.