Investors and hedgers blind to potential underlying risks of the eurozone

29 June 2022

The (inflation) shock is over, back to normal?

5 July 2022INSIGHT • 1 JULY 2022

The gloves are off, but for how long?

Phillip Pearce, Associate Global Capital Markets

It’s clear the gloves are off for central banks as they look to tame inflation with the expense of demand destruction. As of writing, the market expects the Fed rate to peak at 3.5% in March-2023 and New York Fed President Williams stated on Tuesday that a rate of 4% is reasonable. It’s clear that at the next Fed meeting at the end of July, there will be a debate on whether to hike by 50bps or 75bps. Equally, at the last BoE meeting, 3 out of 6 members voted for a 50bps hike and the market is expecting that there will be at least one by year-end if not a surprise 75bps hike. The market expects the BoE rate to peak at 3.25% in March-2023. The ECB is gearing up for its first hike in over a decade as it’s expected the ECB deposit rate will peak at 1.75% by May-2023.

The aggressive hiking cycles are no surprise as everyone is aware of and are experiencing high levels of inflation not seen for generations. What is interesting though is how the market has had somewhat of a pivot of late. Instead of blindly believing that rates will continue on an upward trend till inflation is tamed, there are now signs that thought is being given to the next step in this cycle, i.e. at what point do rates peak and how long until we see rate cuts?

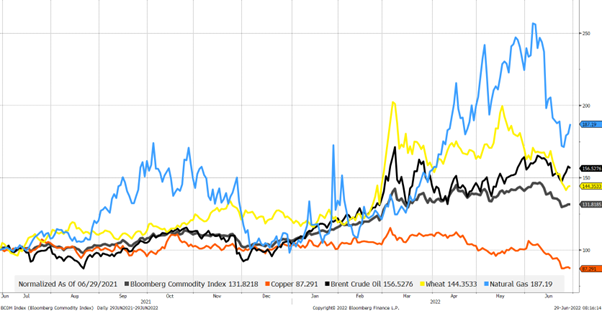

It’s clear a recession is on everyone’s mind just by looking at Google Trends you’ll see a spike in searches of the term to levels last seen at the start of the Pandemic. Central banks have had to destroy demand to bring down inflation as they have no direct control over supply-side factors. Part of demand destruction is higher unemployment and we’ve started to see signs of layoffs occurring in the tech sector as spending needed to be curbed which has a two-fold effect as there are fewer consumers and less corporate investment. Another effect is called the “Bull-Whip Effect”, which in short means that if demand drops, inventory levels at retailers start to rise as orders are based on higher demand estimates. The effect on growth is clear due to less demand, but the “Bull-Whip” effect also means that retailers drop prices to turnover inventory more quickly, which is deflationary. Commodity prices are also coming off from their highs for two main reasons, recessionary fears and demand destruction. It’s evident that the market expects growth to slow if we look at the decline in copper prices which has historically been a barometer for global growth. At the same time, oil prices have somewhat stabilised at elevated levels, wheat prices have declined, and natural gas prices have plummeted, although a rebound in the winter should be expected.

Source: Bloomberg

So, what does this mean for currencies? Well firstly if we look at the Dollar when the Fed came out of the May meeting and stated that 50bps hikes were already aggressive and that a 75bps hike was unlikely, the Dollar weakened as inflationary fears subsided. Then we had the shock April CPI figure and a surprise 75bps hike and the Dollar rebounded aggressively. A lot of Dollar strength is on the back of high levels of risk-off sentiment and if the above-mentioned factors do result in inflation easing, it would be reasonable to expect the Dollar to give up some those gains. In the UK and EU, those inflationary pressures are less likely to ease up due to policy changes and reliance on Russian gas and oil, meaning the BoE and ECB will likely need to remain more hawkish but the Fed may have room to pivot.

Then there’s the question of a recession and it could be argued that that ship has sailed already and all we’re waiting on is the data to confirm the inevitable. A recession is certainly a negative, but if it’s viewed as the trigger for a possible dovish pivot, that too would mean sentiment turns from very risk-off to less risk-off and less Dollar strength. Much the same as central banks, currencies will need to see how data evolves but there’s an argument building that if the stars align a weaker Dollar and less risk-off sentiment could be on the horizon.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.