Recession Risks Loom as the Inflation Fight Rolls On

24 June 2022

The gloves are off, but for how long?

1 July 2022INSIGHT • 29 JUNE 2022

Investors and hedgers blind to potential underlying risks of the eurozone

Shane O’Neill, Head of Interest Rate Trading

By now we are all aware of the jolt of volatility that has been dealt to macro markets across the world – FX and, more pertinently, rates markets are moving aggressively and reaching levels not seen for years, and in some cases, decades. The Bank of England may have been first off the mark, and the Fed may be expected to move rates by the most, but the market most liable to shock is that of the Eurozone. Having been, without question, the sleeping giant of the last decade, hedgers and investors had become blind to the potential underlying risks. Money was free and volatility was close to zero, but not anymore – here we will take a quick look at the sources of this volatility, which sources are most worrying, and what new sources of volatility may lie ahead.

Market Moves Return

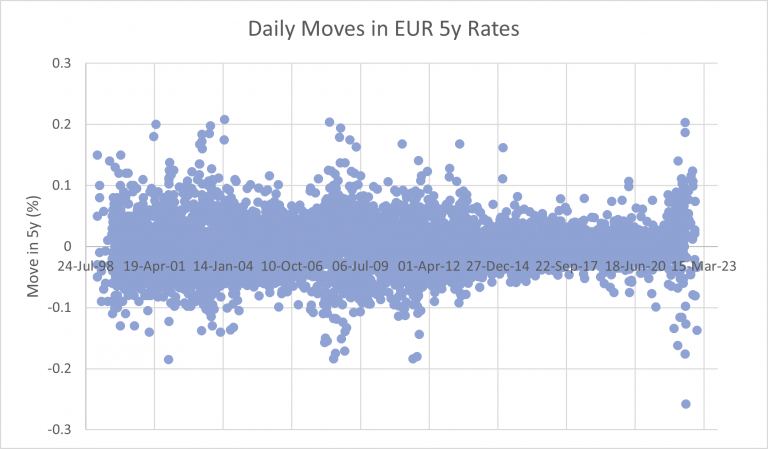

Much has been made about the recent pick up in market volatility but exactly how bad are conditions at the moment? This last period has been one of the most volatile since the creation of the Euro in 1999 and the intraday moves are lurching in both directions. In the month of June alone, we have seen the largest ever one-day move lower in 5y swap rates and two of the largest moves higher. These are moves which are comparable and bigger than those seen during Euro debt crises and the GFC. Implied volatility, a market measure of how volatile the next period is expected to be, has trebled in the last year – reaching its highest levels on record.

Chart 1: EUR 5y swaps are experiencing volatility that, on some measures, has never been seen before

Source: Bloomberg

The jump in market volatility was started by the jump in rate expectations – though the last central bank to fully acknowledge the non-transitory nature of inflation, the ECB finally buckled and now hikes are on the horizon. After only moving in 10bps increments since 2014, the bank is now expected to hike in 25-50bps jumps, with the depo rate finishing the year at 1% – a generational move for a central bank which has presided over zero, or lower, depo rates since 2012.

Fragile Bloc

If sticky inflation and higher rates is the primary risk on the minds of the ECB, and the primary driver of the current bout of volatility, bloc fragmentation is a close second. As the market became more certain that the QE era was over in Europe, different yields moved in different magnitudes – the much-watched German/Italian 10y spread jumped to Covid crisis levels, prompting the ECB to hold an emergency conference which sent the spread tighter by some 40bps. The market now awaits more concrete details around their plan to control such spreads. An underwhelming plan could easily send these spreads back to their highs, and higher.

Corporate Bonds and Forward Indicators Wobble

As financial conditions across the bloc tighten, corporate debt is experiencing its worst performance run in decades – investment grade debt in Europe has yielded negative returns for the last seven months, a run worse than during the Covid crisis or the GFC of 2008. Whilst this performance is to the benefit of private debt funds (we have already seen more and more capital raisers avoid volatile public markets in favour of direct from fund borrowing), it is another source of volatility the market will watch closely. As companies begin to feel the pinch of higher rates and wider spreads on their debt burden, it could expediate an incoming recession and if that were to be the case, what would the ECB do? If inflation still lingers well above target, can they revert to tried and tested loosening methods? If not, what other tools do they have? Or will they simply have to re-mark target inflation for a “new” economic environment? Whatever the solution, volatility is assured.

Forward-looking economic data is also starting to turn, another potential cause for concern. Recent EU PMIs (purchasing managers index) have taken a turn lower, and although still in growth territory (>50), the fall from above 60 to where we are now is indicative of ever-growing recession concerns.

Chart 2: EU PMIs have been on a downward trend since last year, a worrying sign of growth issues on the horizon

Source: Bloomberg

In times of such elevated market volatility, hedging becomes ever more important and difficult – timing becomes paramount and hedgers who have the most cushion in terms of timing will do best. An efficient onboarding process, finished far before any mandatory hedge date, will allow risk managers to take advantage of market pullbacks, rather than being forced into a hedge at the worst time. Even if the trend in rates markets is higher, for now, there are still opportunities presented, such as the large lurch lower we saw this month – those risk managers who are prepared and ready to trade, will benefit most from even the briefest market respite.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.