INSIGHT • 21 JUNE 2022

False signals: has the Fed damaged its credibility?

Ali Jaffari, Head of North American Capital Markets

Coming out of last month’s Fed meeting (May 4), where a 50bps hike was administered, Powell’s statement gave little confidence for a 75bps hike. Fast forward a month later, with mounting inflationary pressures, the Fed delivered a grand 75bps hike, it’s largest in almost three decades. At its recent press conference, a number of financial correspondents posed a similar question cut several different ways – all boiling down to the Fed’s credibility. Financial markets remain susceptible to shocks under an elusive monetary policy regime. Hence, it’s worth considering – is credibility waning for the Fed and what are the risk factors in play should the it deviate from its indication?

What’s clear coming out of the recent FOMC is that the Fed will continue to react to the incoming data. Data-dependency is a basic principle across central banks globally, however in the current economic environment with rising uncertainty, it begs the question of how close the market should focus on the Fed’s forward-looking guidance (i.e. the dot plot and summary of economic projections).

Whether the 75bps hike renewed confidence in the Fed’s ability to tackle inflation remains to be seen. Powell was quick to note that future hikes were not to be implied at 75bps, but a minimum of 50 bps seems plausible. At the onset, market implied inflation expectations (an indicator closely monitored by the Fed), have been on the decline (see Chart 1). If this trend continues, it’s unlikely that we will see another 75bps hike by the Fed at the next meeting, unless inflation data (CPI) prints continue to surprise to the upside.

Chart 1: Inflation Expectations – 5Y (black) and 10Y (blue)

Source: Bloomberg

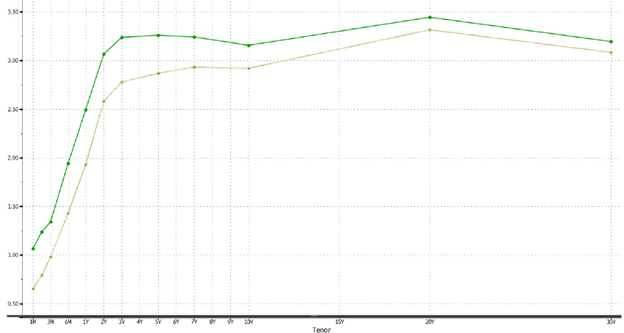

Despite the plummet in risk assets, the Fed remains committed to its goal of 2% inflation. Congruent with the hike in policy rates, front-end USD rates continue to spike (see Chart 2), with the 2-year yield now hovering above the 3% level. Support for the USD remains strong on the back of an aggressive Fed (vs other central banks) and the elevated geopolitical risk environment. If the Fed keeps its commitment to unconditionally tackle inflation (overlooking near-term recessionary indicators), upward USD momentum is likely to persist.

Chart 2: US Yield Curve – Current (green) vs 1-Month Prior (gold)

Source: Bloomberg

Looking out to the end of the year, based on Fed guidance, the market is currently pricing in an additional 200bps of hikes (with 4 meetings to go, that’s 50bps per cycle). Inflation data remains critical and policy measures could easily deviate from the current consensus (residual 200bps of hikes) should CPI under or overshoot. Here are scenarios to consider on risk factors from the Fed and the resulting impact to the dollar.

Scenario 1:

Despite tightening efforts from the Fed, inflation fails to respond and continues to surprise to the upside.

This will certainly place pressure for additional tightening measures, perhaps seeking continuous hikes at 75bps, or the introduction of a 100bps hike. It’s likely the market will react ahead of the Fed’s confirmation (as it typically does) and begin to price in aggressive hikes. Ultimately, interest rate differentials will further diverge between the US and other nations, and the isolating impact would lead to continued USD strength.

Scenario 2:

Inflation persists higher however it is largely driven by supply side factors, where the Fed’s toolkit has limited scope.

The Fed’s toolkit is mainly a remedy for demand-driven inflation. If supply-driven factors (such as the Russia-Ukraine crisis and the impact on energy prices) continue to exacerbate price pressures, the Fed is likely to moderate its tightening approach. In the near-term, this will be viewed negatively from the market and the 200bps of hikes baked in (to the end of the year) will reduce, halting the dollar’s bull run.

Scenario 3:

Following recent aggressive 50bps and 75bps hikes, the Fed may decide to be cautious especially as inflation expectations fall back (see Chart 1).

Post the policy announcement, we’re already seeing Fed officials on the wires, with some supportive of a continued 75bps hiking cycle, while others are more wary of the impact this recent hike could have on the economy. Recessionary indicators, such as the inverted yield curve (see Chart 2), are just the start and a projected slowdown in economic activity is underway. Coupled with a continued decline in inflation expectations – the Fed may not be as aggressive as positioned by the market and we could see a swift reversal in USD.

The Fed’s credibility will continue to be in question over the coming months, hence continue to monitor the data and be prepared for course changes. As we navigate through a period of economic fragility, having sound risk management practices is paramount.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.