Pegged Currencies: Jump Risk Hiding in Plain Sight

9 June 2022

What’s Driving the Pound?

14 June 2022INSIGHT • 13 JUNE 2022

Certainly Uncertain: Factors Driving the Euro in the Coming Months

Harry Woolman, Analyst, Global Capital Markets

“Within our mandate we are committed to preventing fragmentation risks within the euro area”

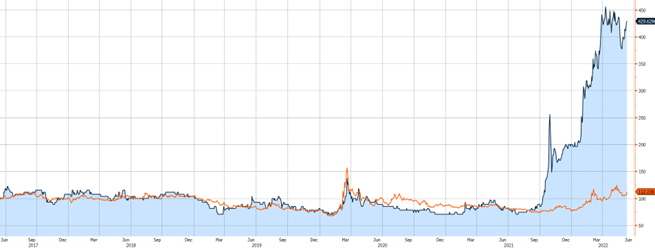

Normalised Euribor 2Y swap volatility (blue) versus EURUSD 1Y at-the-money option volatility (orange).

Source: Bloomberg

Historically, euro currency and rates volatility have been closely correlated. However, the correlation broke down in Q4 2021, when it became clearer that policymakers would have to act to tame rampant inflation; Euribor-denominated rates volatility has increased over 100% to record levels since the start of 2022. Should currency volatility begin to align with moves in the rates world, those with euro exposure are set for a bumpy ride, as the cost of hedging would rise dramatically – and there are plenty of sources for such volatility.

Peripheral Risks Take Centre Stage

The economic future for so-called “peripheral” EU states looks increasingly uncertain. During her post-meeting press conference, Christine Lagarde’s noncommittal stance on the increasing cost of peripheral debt only added to market jitters, with the euro almost immediately retracing (and more) ground made up because of a hawkish pivot in the ECB’s forward guidance. Clearly, markets view the prospect of higher eurozone rates with trepidation in the absence of a plan to keep certain yields from tearing higher. Italian and Greek debt-to-GDP ratios sit at approximately 150% and 200% respectively, making Lagarde’s job that much more difficult, and the macroeconomic backdrop that much more volatile.

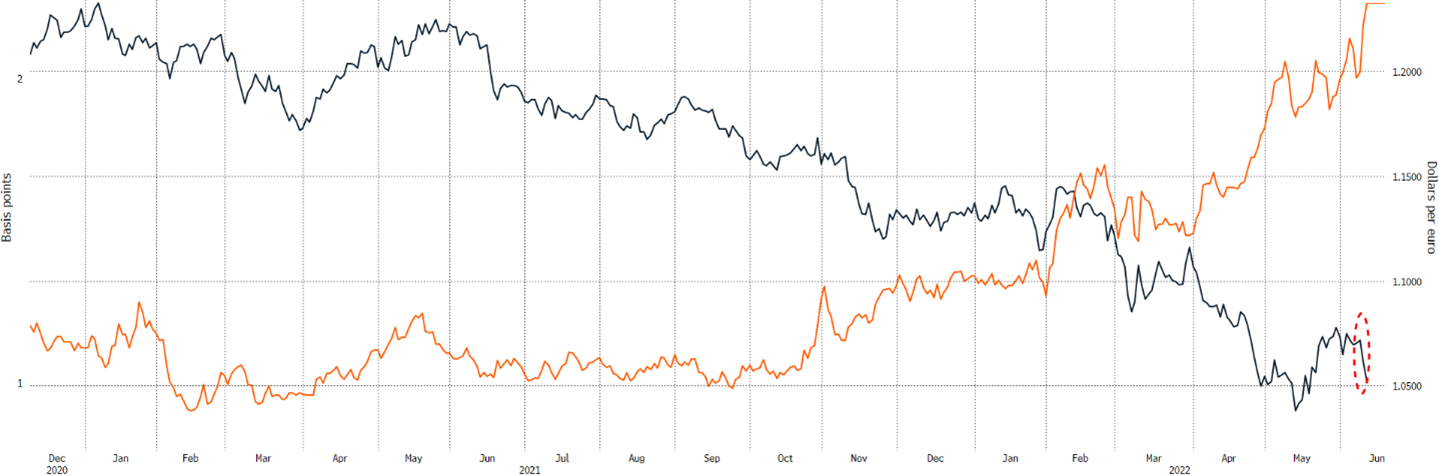

Upward revisions in inflation forecasts for each of the next three years pushed peripheral spreads higher still, with the Italian-German ten-year spread reaching levels last seen in May 2020. If inflation expectations up to and including 2024 are realised, it would mark four straight years of CPI overshooting the ECB inflation target of 2% – highlighting why it is essential for the ECB to hike rates and stop bond purchases. Though higher rates and less liquidity could support a currency; the market is currently more concerned about the Eurozone project’s future. Following last week’s meeting euro crosses suffered across the board, with the intraday drop against the dollar highlighted in the red circle in the image below.

Italy-Germany ten-year spread (orange) advances at the expense of EURUSD (blue).

Source: Bloomberg

Higher Rates, Higher Euro?

But should the ECB come up with a viable plan to control fragmentation perhaps the market will refocus on the bloc’s attractive higher rates – potentially taking the euro higher. Market pricing moved to account for Lagarde’s hawkish tone, with 50 basis points worth of hikes all but priced in at one of the next two policy meetings. Additionally, markets now foresee rate hikes to top 150 basis points by year-end, leaving the deposit rate in the eurozone at 1%. Though the concept of “terminal rate” is part science, part art – there is good reason to believe the EU is further from their terminal rate than the Fed or the BoE. Meaning each additional hike in Europe should be more positive for the euro than their counterparts’ currencies, as the BoE and Fed hike ever closer to restrictive territory.

Russian Risks Persist

Ongoing issues on the eastern front (Russia, Ukraine and the EU: Risks Ratchet Upward) add yet further two-way risk for the single currency – embargoes from the EU on sea-freighted Russian oil leaves the bloc short the equivalent of 2.3million barrels of oil per day, according to some estimates. With most OPEC+ nations already operating at capacity, finding, and then transporting the equivalent amount of oil looks set to underpin elevated price rises over the medium term.

Conversely, a noticeable improvement in the Ukraine situation could provide support for the euro by alleviating longer-term supply chain concerns, whilst bringing back a modicum of stability to the global geopolitical order. We have already seen that talks of peace between Ukrainian and Russian leaders have provided a boon to riskier assets and brought down bond yields at various points since the outbreak of war. Intuitively, sustained peace talks / ceasefire negotiations would therefore instigate a more risk-positive environment, bringing the euro and euro-denominated investments back in vogue.

With two-way risk abound, the next few months are sure to be bumpy for euro exposed investors and risk managers – though implied volatilities have increased, the cost of hedging can go much further, just ask euro rates hedgers. The status quo is gone, a year ago EURUSD was ~20 big figures higher – it is as hard as it has ever been to call whether we go back to the 1.20s or break below parity, which is why it is a prudent time to take another look at hedging policies in place and to take euro linked risks off the table.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.