Central Bankers Spark Further Inflation Fear

27 May 2022

New Zealand and Canadian central banks are canaries in the inflation coal mine – what can other G10 countries learn?

7 June 2022INSIGHT • 31 MAY 2022

Russia, Ukraine and the EU: risks rachet upward

Kambiz Kazemi, Chief Investment Officer

Following the unlawful invasion of Ukraine by Russian forces, the euro weakened progressively – dipping briefly below the 1.04 mark in mid-May – reflecting the risks and the negative impact that the proximity of the conflict could have on the economic and geopolitical outlook of the Eurozone.

In recent weeks, as Ms. Lagarde finally changed her tone with regard to the sustained and rampant inflation in the Eurozone, as expectations of rate hikes have increased and helped the euro gain some ground against most major currencies (see chart 1).

Chart 1: EUR/USD cross spot rate

Source: Bloomberg

This weekend was filled with new information and developments in Europe with regard to Russia and sanctions. On May 27th, the Italian Prime Minister Mario Draghi called Vladimir Putin to discuss the potential looming food crisis due to the disruption of Russian and Ukrainian grain exports caused by the conflict.

This was followed by an 80-minute call by French President Macron, German Chancellor Scholz and Putin on May 29th, ahead of EU’s meeting on sanctions on Russia the next day. The European leaders urged Putin to engage in direct negotiation with Ukrainian President Zelensky. The issue of the transport of grains from Ukrainian ports in the Black Sea was also discussed and Putin seems to have indicated that Russia would be amenable to allow such transportation, conditional on relaxation of relevant sanctions.

These calls by the leaders of the top three economies of the Eurozone were followed on Monday (May 30th) by a meeting of EU member states, where after one month of wrangling finally energy sanctions on Russia were decided. A watered downed version of the initial proposal imposes sanction on all maritime Russian exports (two thirds of EU imports from Russia) by year end, while pipeline imports will not be affected at this point. The main takeaways from these latest developments are:

- EU leaders are increasingly alert to a potential food crisis, that may have limited effect in the EU but would see major hardship globally with potential direct impacts on the EU via immigration and other channels.

- The energy dependency of the EU on Russia continues to be a major weakness. Hungary’s recent veto of sanctions, and month-long negotiations that ended in only partial and incremental sanctions over a lengthy time horizon, underline the difficulties the EU faces on the energy front. The implementation of energy conservation campaigns by some countries and the initiation of government subsidies to alleviate the hardship caused by higher energy prices further highlight the difficult constraints Europeans face.

- The latest overtures by EU leaders in order to suggest/promote negotiations between parties have left some Baltic politicians very unhappy.

- Any expectation or actual relaxation of export restrictions on grains will see the price of these commodities readjust lower in the short term (longer-term, the issue of new crops remains of relevance and uncertain).

- Any signs or news of resumption of meaningful negotiations is likely to be constructive for risk assets in general and could have a weakening effect on the price of some commodities that have been directly affected by the conflict (oil, nickel and palladium, for example).

- Among risk assets, the euro is likely to see a relief rally – reversing part or whole of its move lower since February. This, combined with the positive sentiment that is likely to take hold in EU under such a scenario, could exacerbate the potential move higher in euro.

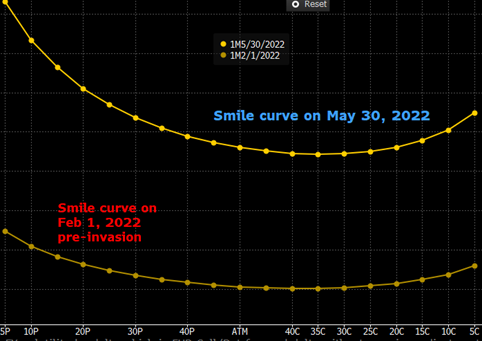

Chart 2: EURUSD smile is more pronounced to the downside (weaker euro hedges are in demand)

Source: Bloomberg

All the above means that the “pain trade” can be a rally in EUR/USD where short covering could be accompanied by a combination of likely purchase flows of by options market makers, reversal of short trends following positions and/or establishing of new uptrend positions. It also means that we may see a reduction or readjustment of some carry positions especially if an improved sentiment is translated into expectation of a more hawkish ECB. It is wise to be prepared for such eventuality – which might not be highly likely presently but could become so in the weeks and months ahead.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.