A new world order: can the dollar defend its global reserve currency crown?

6 May 2022

Treading the inflation tight rope: can the BoE keep its balance?

17 May 2022INSIGHT • 10 MAY 2022

Hawkish Peak to Thread the Needle?

Phillip Pearce, Associate Global Capital Markets

“The FOMC is not actively considering 75 bps hikes”

Jerome Powell, Fed Meeting on 4-May-2022

Last week, we had several central bank meetings with the Reserve Bank of Australia, the Fed, and the BoE all hiking rates. The RBA’s hike of 25bps was the first time in 11 years that the cash rate was raised. The Fed’s 50bps hike was the 1st rate hike of such magnitude in over 20 years and its 2nd hike of the year. It also announced the schedule and pace of its balance sheet runoff (read QT). The BoE raised rates for the 4th time in as many meetings. We also had ECB members talking up the prospects of a rate hike and the end of net asset purchases as early as July. The running theme, which is well known by now, is that inflation needs to be brought under control.

This all shows clear hawkish tilts, and that’s what central banks have been trying to guide markets towards but there were some surprising admissions in the BoE and Fed conferences after each meeting. First, let’s look at the Fed: 2 weeks before the 4-May meeting, Fed member James Bullard opened a debate on the Fed doing a more aggressive hike of 75bps. Fed Chair, Jerome Powell, around the same time emphatically endorsed a 50bps hike but because of Bullard’s comments, markets thought the Fed and Powell were seriously considering 75bps. Fast forward to post the Fed meeting and Jerome Powell ruled out a 75bps hike and James Bullard has stated that 50bps hikes were “already a pretty aggressive move” – a minor bundling of the forward guidance in my opinion.

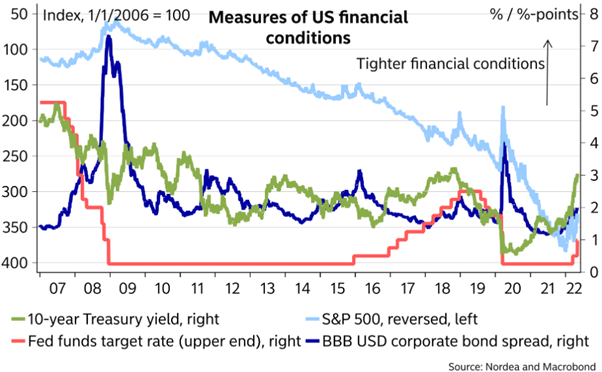

Jerome Powell also stated ‘‘assuming that economic and financial conditions evolve in line with expectations, there is a broad sense on the Committee that additional 50 basis point increases should be on the table at the next couple of meetings’’. Now, this is key to “threading the needle” and engineering a soft landing, financial conditions have tightened considerably but the Fed is worried that if they continue to do so it will lead to recession. So, they need to balance “aggressively” tackling inflation but not to such a degree that they choke the economy.

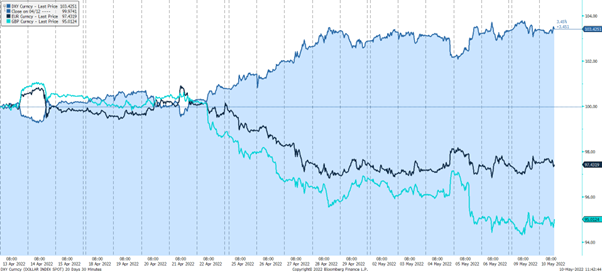

Now to the BoE and the striking forecasts that came out of the meeting were that inflation was expected to hit 10% this year and a 1% contraction was expected in Q4. What was interesting though was that some members thought forward guidance of further rate hikes was no longer appropriate, essentially trying to taper the market’s expectations and attempt to “thread the needle” once again. Cable (GBPUSD) came off heavily after the negative outlook and the dollar has benefitted through its status as a haven, which ultimately hurt the Euro as well.

The relative performance of the Dollar Index, EURUSD, and GBPUSD over the past month

Source: Bloomberg

Ultimately, the remarks from both the Fed and BoE have resulted in markets repricing the expected target rates for the end of the year with the market now expecting US rates to reach 2.75% and UK rates to reach 2% vs. 3% and 2.25% respectively prior the meetings. The ECB is forecasted to reach a positive deposit facility rate of 0.25%. The terms dovish and hawkish are all relative, the BoE and Fed are far more hawkish than the ECB if the time horizon is the past 6 months, but if you look at the comments over the past week, it’s the ECB that is more hawkish (albeit they are a bit late to the party). I think what’s unfolded over the last week is more of a “pause and assess” how conditions unfold than a definite “hawkish peak”. Central banks are guiding us to believe that they are delicately engineering a soft landing but it’s heavily dependent on how conditions evolve, making the eye of the needle exceptionally small.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.