How low can the euro go?

3 May 2022

Hawkish Peak to Thread the Needle?

10 May 2022INSIGHT • 6 MAY 2022

A new world order: can the dollar defend its global reserve currency crown?

Jesús Cabra Guisasola, Senior Associate, Global Capital Markets

“Gold is money everything else is credit.”

J.P. Morgan – 1912

“Having a reserve currency is one of the greatest powers a country can have because, it gives the country enormous buying power and geopolitical power”

Ray Dalio – Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail

Back in 1974, the United States in collaboration with Saudi Arabia and the rest of OPEC set up the petrodollar system, an agreement where OPEC countries would only sell their oil in US dollars and invest some of those dollars back into US Treasury securities to hold them as reverses and earn yields. In exchange, the United States promised to maintain stability in the region by providing military support when needed.

This system has been in place for five decades, securing US treasuries’ position as one of the main assets in the global financial system and the US dollar as the global reserve currency.

This has allowed the US to enjoy a position of privilege, enabling it to benefit from lower borrowing costs, a stable exchange rate and run big deficits by printing more money without fear of defaulting on its commitments. Also, US companies benefit from not having to worry about exchange rate risk when buying commodities from foreign countries.

Having a reserve currency is therefore great while it lasts, because it gives a country exceptional borrowing, spending power and significant control over who else in the world gets the money and credit needed to buy and sell internationally. On the other hand, non-reserve currency countries find themselves in a situation of disadvantage when they have a lot of debt denominated in the foreign currency (e.g., US dollar) which they can’t print.

This happened in Argentina in the late 90s and early 2000s when the country defaulted on its external debt and suffered a large devaluation of the peso against the US dollar, which plunged the country into a financial crisis that continues today. The Argentinian government is currently refinancing some outstanding debts with the IMF that they were due to pay $19bn in 2022 and $20bn in 2023.

Nevertheless, the country with the reserve currency also suffers some drawbacks given the status allows the country to borrow more than it can afford, print large amounts of money and create credit to service its own debt, which devalues the currency in the long term. The petrodollar system also gave the U.S. a form of “Dutch Disease”.

The Dutch Disease is a term that was coined by The Economist in 1977 when it analysed the crisis which originated in Netherlands after the country discovered deposits of natural gas in the North Sea back 1959. This term is now used to describe situations that seem good on paper (i.e., discovery of natural gas reserves), but have a negative impact on the overall economy of a country.

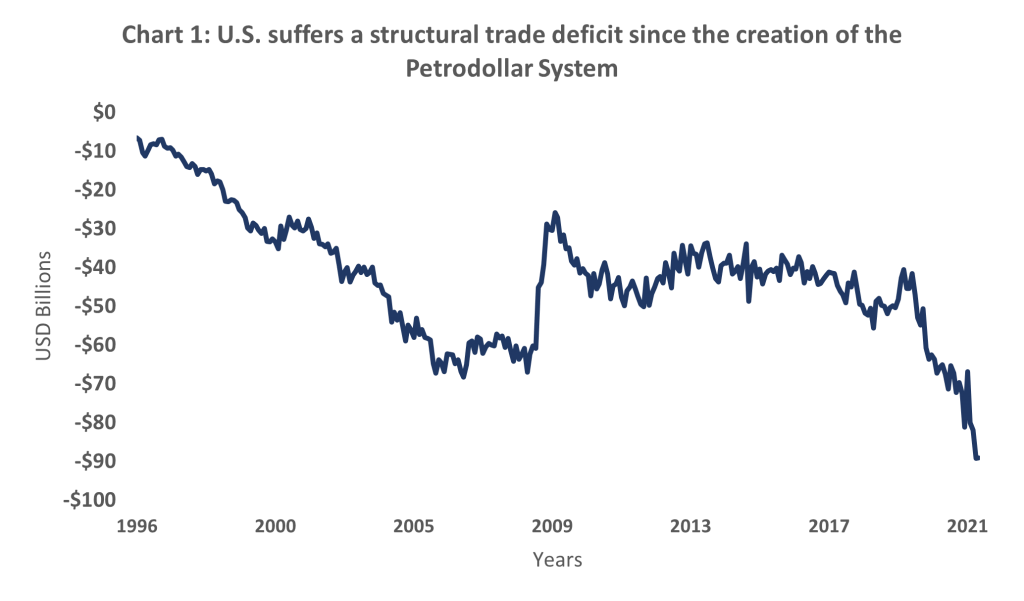

The U.S. did not discover any deposits of oil or natural gas, but by pricing oil in dollars, it gave the United States a similar Dutch disease to the one that the Netherlands had suffered years before, as every country would need to import dollars to pay for oil consumption – creating a structural trade deficit for the U.S.

Source: Bloomberg

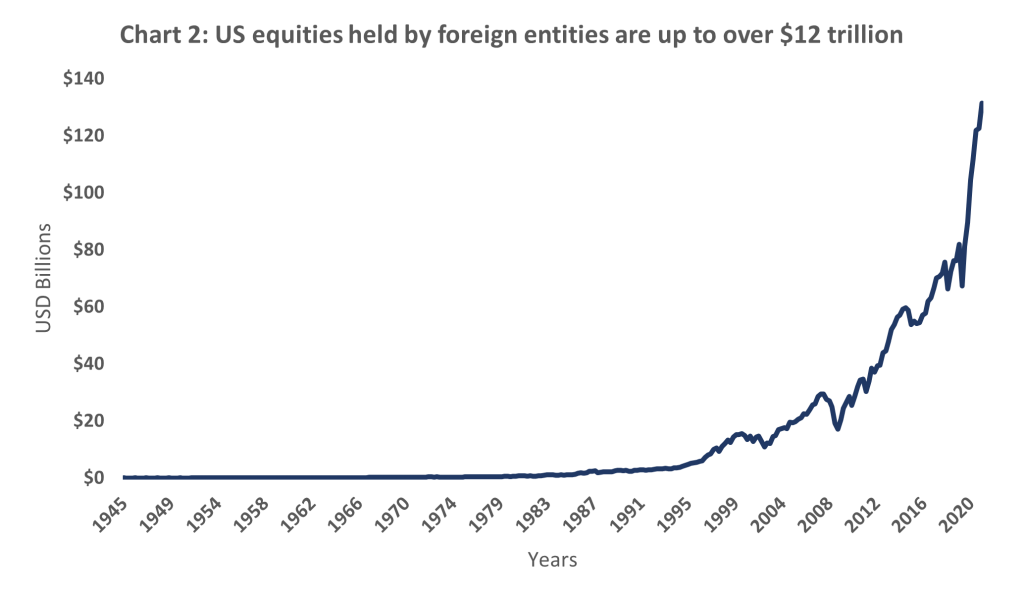

Trillions of Dollars in accumulated trade deficit have become surplus for other countries that first started investing in US treasuries but have now shifted to other asset classes (i.e., US equities, real estate, etc.). This means that the United States, which used to be the world’s largest creditor, has now become the world’s largest debtor. Chart below shows the value of US equities in hands of foreign countries.

Source: Bloomberg

On the back of the conflict between Russia and Ukraine, we are now witnessing a shift in the current status quo with countries like Saudi Arabia pushing to start using other currencies for its oil sales. Recently, a report from the WSJ flagged that Saudi Arabia was in active talks with Beijing to start accepting Yuan, a drastic move that would put China, the biggest importer of oil, in a position where it would not need to continue building its dollar reserves to buy oil from foreign countries.

This decision from the Saudis comes after years of growing increasingly unhappy with the U.S. given their lack of support in intervening in certain conflicts such as the Yemen civil war, the U.S. withdrawal from Afghanistan last year, and from the Biden administration’s attempt at an Iranian nuclear deal.

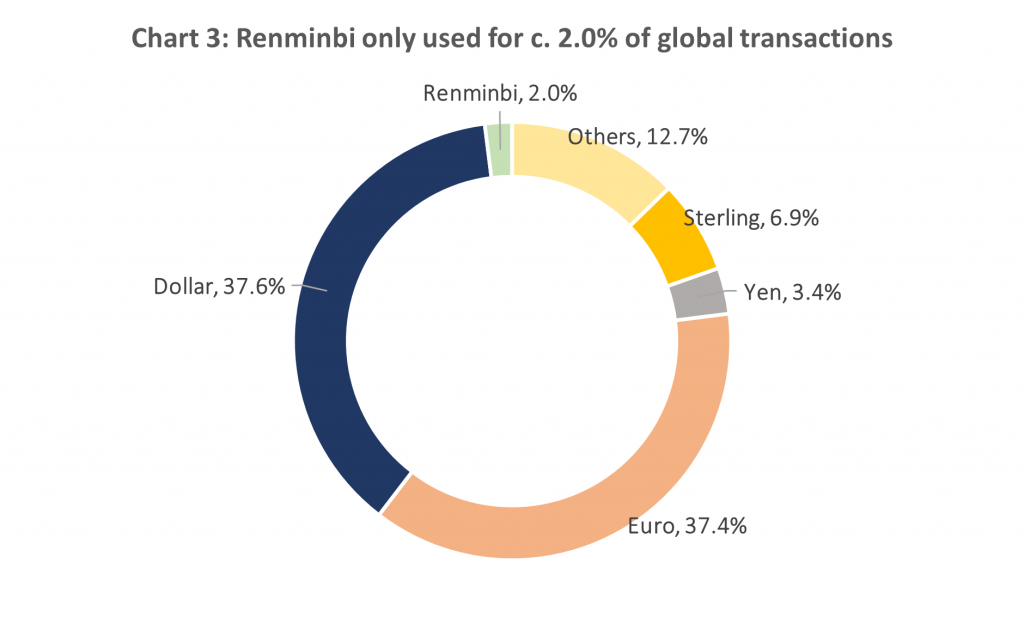

Some people have argued that yuan could become the new global currency reserve, but could the Chinese Renminbi dethrone the US dollar?

We have seen some countries like Russia unwinding its US dollar reserves and moving towards Chinese renminbi and gold. Perhaps, anticipating a scenario with sanctions from Western countries resulting from a geopolitical escalation between both blocs. However, looking at the numbers, only 2.7% of international transactions are completed in yuan, and not even commodity producers in China use the Renminbi.

Source: Bloomberg

In recent years, China has been opening its stock and bond markets to foreign investors. However, it does it through cross-border exchange programs that link the Chinese onshore market with those in Hong Kong, which are specifically designed to receive foreign investments while maintaining a limit on the amount of China’s currency which can flow oversees. These investments from foreign investors can be withdrawn easily, but Chinese investors are subject to strict capital controls. This allows Beijing and the central bank to maintain control over the renminbi’s exchange rates and limit the amount of renminbi that other countries can hold as reserves.

In 2015, China appeared willing to internationalize the renminbi. However, this was difficult when the greenback surged and the renminbi appreciated, making Chinese exports less competitive. That prompted the People’s Bank of China (PBoC) to devalue the renminbi and keep a soft peg of the currency to the US dollar which has worsened over the years pushing the government to impose strict capital controls.

Therefore, if China wants the renminbi to dethrone the US dollar as the global reserve currency, it will need to open its economy, loosen capital controls, and leave the renminbi to float freely.

What next?

Former Governor of the Bank of England, Mark Carney, raised this concern back in 2019 during the Jackson Hole Symposium and in front of the US Federal Reserve, when he highlighted that the US dollar as a global reserve was too risky for the current financial system and proposed a digital currency based on a global basket of goods to replace it.

Some have proposed different alternatives to the current system (i.e., bitcoin, or other digital currencies or even the return to the gold standard).

It is clear that the US dollar will lose its privileged position as a global reserve currency in the long term and be replaced by a more decentralized system in which not all transactions are tied to a specific country’s currency but instead to the euro, yuan, and perhaps a few others, or alternatively a neutral reserve currency is used. This is already gradually emerging throughout Eurasia with countries using other currencies for energy and commodities transactions.

However, a more abrupt shift could happen if there are further escalations in the conflict between Russia and western countries. This could accelerate the gradual change that we are witnessing, with countries like China and India growing sceptical of the U.S. and following Russia’s steps to start using its own currencies for international transactions. This would lead to a sell-off in US treasuries, pushing interest rates higher, and the US dollar lower. An uncharted scenario, which when coupled with the Fed’s readiness to halt active bond purchases could cause further disruptions and dislocations in the market and put the Federal Reserve in the uncomfortable position of pulling back from its decision of tightening to curb inflation.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.