Five reasons why the dollar could weaken in the coming months

5 April 2022

The Tale of the Yen

19 April 2022INSIGHT • 12 APR 2022

Private Credit and Higher Rates: Opportunities and Costs

Shane O’Neill, Head of Interest Rate Trading, Global Capital Markets

Inflation, higher interest rates and, most recently, war have roiled financial markets during the first quarter of 2022. Consumer and investor confidence is tumbling, and public markets are feeling the pressure – IPO’s, which had boomed in 2021, have ground to a halt with reports of the usually hectic schedule of City bankers seeing an increase in mid-afternoon pub visits. Public debt raising hasn’t fared any better – in Europe we have seen the longest drought in high yield bond sales in over a decade. With this critical source of funding drying up, others have had to fill the gap but as with any financial volatility, opportunities abound.

Following the GFC in 2008 banks pulled back from much of their traditional lending markets and the space was quickly filled by private credit funds. The private credit asset class is currently worth an estimated $1.3trn and some are expecting this to double over the next five years – a slowing public market will only expediate this growth. Additionally, the floating rate returns (most private lending is on a floating rate basis) can deliver investors with greater protection on returns in a rising interest rate environment than their equity equivalents – another potential growth story for private credit in the coming months.

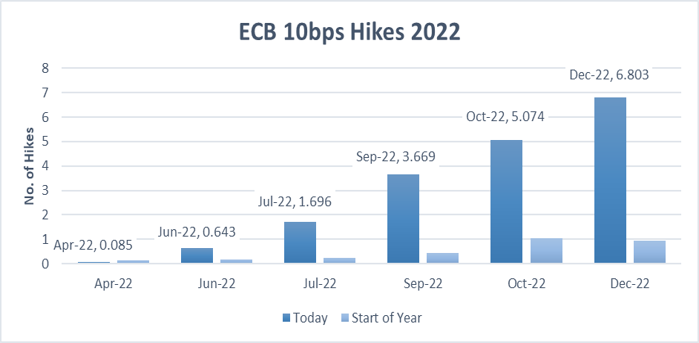

But higher rates and increased volatility in financial markets also introduce more risk – over the past decade interest rate markets have been unusually benign, and it was during this period that private credit took off. Rates markets are now pricing in a faster hiking cycle than almost any market participant will have seen – with 2.5% of tightening expected from the Fed in 2022, a further 1.5% from the BoE, and 0.70% from the ECB – the first time the ECB deposit rate will have increased in over 10 years.

The expected tightening from the ECB has rocketed in the first quarter of 2022

Source: Bloomberg

Quiet markets and low interest rates often translated into soft, or missing, hedging requirements – leaving borrowers with useless high strike caps or no rates hedge at all. Existing loans which cover the next few years may feel the pinch from the lack of hedging – central bankers have made it clear that rates will be increased until inflation is curtailed, even if that means going beyond “neutral”. Taking rates into restrictive territory has greatly increased the chances of a recession in the next couple of years. Market indicators are also pointing to a slowdown in activity, the swap curve in the US recently inverted, often cited as a warning of upcoming recession. Higher rates, slowing growth and a cost-of-living squeeze could prove to be the perfect storm for under hedged borrowers, and by association, will hit private credit fund returns in the coming years.

Even borrowers with hedging clauses in their contracts are being caught off-guard by recent moves – as volatility and forward curves increase, the cost of hedging is significantly higher. A common hedge methodology is to agree contract terms, drawdown and then engage an advisor and bank, only to find out that the cost of that hedge has jumped – a 2% EURIBOR cap for 5 years has increased by more than 12x over the last year, for example. Without an awareness of the cost of hedging, a borrower cannot accurately analyse the cost of borrowing – and indeed, the terms of the hedging policy can have dramatic effects on the overall cost of the debt. Whether under hedged or unaware of the full cost of financing, interest rate implications can be dire for borrowers and in turn, can damage returns for the fund.

The cost of EUR caps has increased dramatically over the last 12 months

Source: Bloomberg

Another challenge which comes with the growth of the asset class is increased competition – in the last week, both Barclays and RBC have expressed their willingness to get involved in the world of private credit. With more money chasing deals, funds will have to separate themselves from the competition. Other than a race to the bottom in terms of margin, funds may consider assuming some of the rates hedging burden from the borrower – simultaneously removing an arduous process, reducing the rate risk on their investment, and effectively communicating the real cost of the debt.

Increasing rates and volatility is presenting several opportunities for private credit but not without concerns. From our vantage point, the funds which are first movers in terms of leveraging interest rate derivatives to both hedge risks and increase product offerings, will be well placed to succeed in the next period of private credit growth.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.