The dollar’s getting ahead of itself: three likely risk scenarios

4 April 2022

Private Credit and Higher Rates: Opportunities and Costs

12 April 2022INSIGHT • 05 APR 2022

Five reasons why the dollar could weaken in the coming months

Marc Cogliatti, Principal, Global Capital Markets

In recent weeks, we’ve seen a couple of major investment banks switch their view on the US dollar from bullish to bearish. Cynics would argue that this is a sure-fire indicator that the dollar is ready for another upward leg, but after a period of relative calm, there is certainly some merit in considering five factors that could result in a weaker dollar in the months ahead:

1. De-escalation of tensions in Ukraine

Last week’s news of “constructive” talks between Russia and Ukraine delegates and the pull back of Russian troops from Kiev gave a significant boost to risk assets and helped ‘risky’ currencies advance against the safe haven dollar. While uncertainty remains high, the latest commentary suggests a shift away from the more negative scenarios (both from an economic and market perspective).

2. Expectations of higher rates no longer benefiting the dollar

The aggressive repricing of the dollar swaps curve has resulted in minimal impact on the dollar index. Traditionally, expectations of higher rates would boost a currency, but the fact the dollar is no longer advancing, suggests that appetite for the greenback is beginning to wane.

3. Inflation is a global problem

Although inflation in the Eurozone took a little longer to materialise than it did elsewhere, stronger than expected CPI prints in both Germany and Spain last week showed that rising prices are rife across the globe. Consequently, the yield on 2-year German Bunds is now positive for the first time since 2014 and the market is pricing in almost 60 basis points worth of hikes from the ECB by the end of 2022. This in turn makes the euro more attractive to investors who have previously been discouraged from holding euros by negative rates.

4. Inversion of the US yield curve

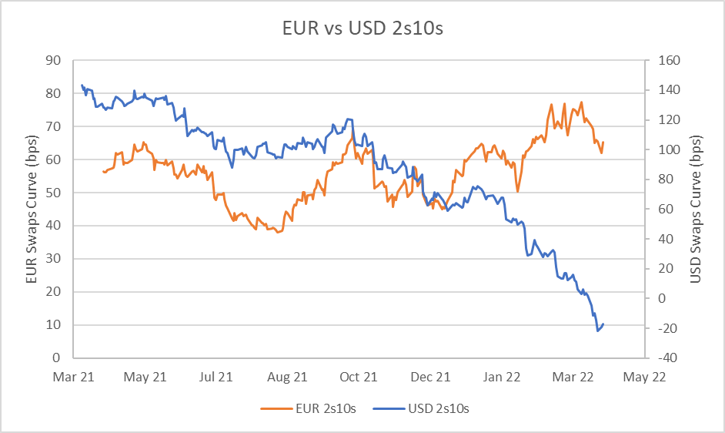

Cited by many commentators as a signal that a recession is looming, news that the 2s/10s curve has inverted, fuelled concerns that the Fed might be forced to back track on its stance against inflation and adopt a slightly less aggressive stance on monetary policy. The chart below shows the US 2s10s dipping into negative territory while the EZ 2s10s looks more normal (i.e. long term rates are higher than short term rates).

5. Valuation

The dollar is currently overvalued on most purchasing power parity metrics and therefore vulnerable to a correction (assuming currencies mean revert over time). For now, the dollar is circa 15% overvalued against the euro and roughly 11% overvalued against the pound, so, far from extreme levels but nevertheless not to be ignored.

Source: Bloomberg

At this stage, we still feel that the recent bout of dollar strength has a little further to run and maintain our mildly bullish outlook. We see a risk that tensions between Russia and Ukraine drag on for a prolonged period, denting risk appetite and maintaining demand for the safe haven dollar. Meanwhile, sustained upward pressure on inflation will likely cause the Fed to maintain a tough stance against inflation and we wouldn’t be surprised to see additional rate hikes priced into the market for 2023, despite the risks of a recession.

Conversely, the challenges facing the euro remain clear. Although the ECB is expected to raise rates later this year, it is likely to lag the Fed, the Bank of England and many emerging market central banks when it comes to tightening monetary policy. The problem of the ‘one size fits all’ approach is again likely to rear its ugly head when trying to satisfy the opposing needs of both the northern and southern European economies.

Finally, whatever the outcome of the Ukraine conflict, the global energy landscape is going to look very different in the years to come. Inevitably, the impact will be felt most in Europe where Russia supplies around 40% of energy. Moving away from being reliant on Russia will take time and come at significant expense which in turn will add to inflationary pressures.

Whatever happens, the need for remaining nimble, albeit within a robust policy framework has never been more apparent.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.