Catch-22: Inflation or Recession?

25 March 2022

The dollar’s getting ahead of itself: three likely risk scenarios

4 April 2022INSIGHT • 29 MAR 2022

In a volatile world, are LATAM currencies a haven or risk?

Ali Jaffari, Head of North American Capital Markets

As the geopolitical risk spectrum continues to deteriorate, market uncertainty remains elevated and asset flows are highly susceptible to headline risk. We’ve seen unprecedented swings across asset classes (including reversals) in recent weeks, and the broader risk-off tone continues to favor USD assets. Nonetheless, LATAM FX has been outperforming the USD and leading the pack across currency majors with Brazil, Colombia, Chile, Peru and Mexico all gaining ground. LATAM currencies no doubt have their own set of regional risk characteristics largely due to heightened political risk and stagflation concerns. Hence, whether this trend holds in the face of the ongoing crises is a point for contention.

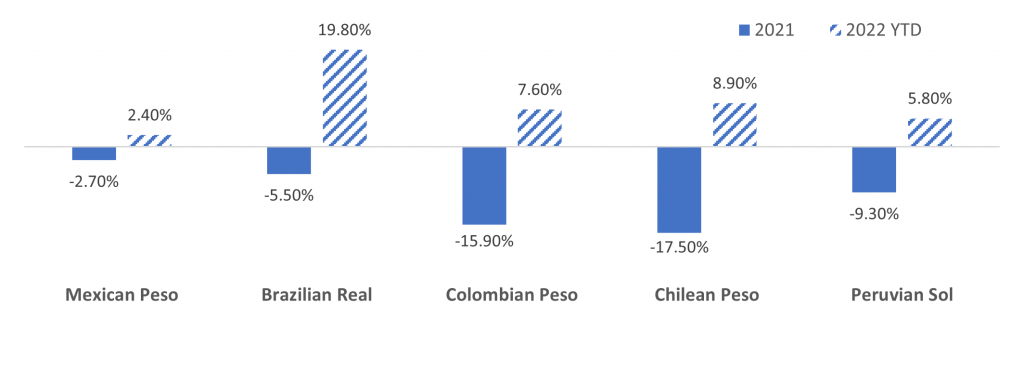

When met with global inflationary pressures, central banks in LATAM markets were at the forefront of the hiking cycle. Brazil kicked-off tightening measures in Q1 of 2021, with Mexico and others following suit shortly after. What ensued was a consistent increase in policy rates to combat the continued rise in inflation. However, contrary to economic theory, LATAM currencies significantly underperformed throughout 2021 (see Chart 1) as the market priced in undue risk related to fiscal / political and Covid related concerns.

Chart 1: LATAM FX Spot Returns vs USD

Source: Bloomberg

2022 performance thus far paint a vastly different picture. Surprising? Not quite. With LATAM net trade flow accounting for under 2% of trade with Russia and the region benefitting from the large run up in commodity prices (particularly oil, but also metals and agriculture), it seems fitting that investors are flocking to regional assets that are slightly more shielded from the Russia-Ukraine crisis. Moreover, real (inflation-adjusted) policy rates, albeit negative in most nations apart from Brazil, are higher than developed nation peers.

In addition to capital flowing into local debt and equity markets (supported by investor friendly reforms), private capital flow into the region is on the rise and global funds need to actively consider the FX risk associated with local currency investments where regional FX volatility is skewed higher. Despite the recent bout of currency appreciation, there are some key risks worth highlighting that could reverse the trend.

1. Divergence of policy rates to developed markets on the decline

As the Fed and other developed markets embark on their tightening cycle, the wide interest rate differential that currently exists will diminish. Despite LATAM central banks continuing their hiking trajectory, the Fed’s 8 hikes that are priced in for the remainder of 2022 will likely outpace that of LATAM nations. Aggressive tightening measures will be undertaken with caution as economic worries and stagflation concerns are on the rise (e.g. Brazil’s Selic rate is already at 5-year high of 11.75%, following 9 hikes delivered in the last year).

With US yields on the rise, a sell-off in emerging market (EM) assets is imminent. However, given the Fed’s transparent approach on tightening measures (to manage the impact to risk assets and other markets), we expect the sell off to be less pronounced than the sudden shock during the taper tantrum of 2013 (US yields skyrocketed followed by an exodus of foreign capital from LATAM assets). Key unknowns here, however, are quantitative tightening measures that are yet to be deployed by the Fed and the underlying impact on treasuries.

2. As supply disruptions emerge, the impact to global growth will weigh heavily on emerging markets

The Russia-Ukraine crisis continues to add to inflationary pressures, in a fragile global economy that is still reeling from the pandemic. Although supply chain concerns have slightly eased from peak disruption, they still remain a real threat to the current economic environment. With trade flow being disrupted, continued sanctions and a rise across the commodity complex, containment of rising inflation is becoming increasing challenging, which is a deterrent to global growth.

The LATAM region relies heavily on its export industry and trade flows – the US alone comprises over 40% of net trade. If a global slowdown were to emerge, the region would be significantly affected and a downturn could occur fairly quick (export revenues slumped by almost a quarter following the GFC).

3. Commodity spikes favor LATAM FX, however tend to be short-lived

Despite the clear support from commodity prices, when analyzing historic correlation between LATAM FX and commodity returns, there are periods when the relationship is strong, however it tends to subside (see Chart 2). Political risk and other country specific risk factors tend to keep reappearing in the spotlight which weigh on the currency strength.

Chart 2: Rolling 2Y Correlation of MSCI LATAM Commodity Return Index vs LATAM FX Performance (USD Base)

Source: Bloomberg

With central bank policy divergence between LATAM and developed nations at its peak, the wide interest rate differential results in steep hedging costs for a foreign fund looking to protect its assets in the region. Risk management remains paramount in times of uncertainty, especially in asset classes where higher volatility is prevalent. Having a good hedging strategy can help navigate through muddy waters while balancing objectives, such as cost and liquidity.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.