Can the UK economy withstand higher rates?

8 March 2022

The risk impact on private capital is changing

22 March 2022INSIGHT • 15 MAR 2022

Russia, Ukraine and the implications of global sanctions: the demise of the dollar?

Shane O’Neill, Head of Interest Rate Trading, Global Capital Markets

Gold is money, everything else is credit

J.P. Morgan

The first quarter of 2022 has been marred by disruption across society – as we started to believe the worst of Covid was behind us, inflation well and truly reared its head. And then, to definitively put other issues into perspective, we saw the first major war on European soil since WW2. In such times of disruption many policy decisions are made by Central Bankers and elected officials, to try to avoid worsening situations. However, as with any policy decision, there are long term implications which may not be immediately obvious.

From a financial markets standpoint, there have been developments around the role and even viability of currency in a post-Covid, post-Ukraine world. Firstly, we had Prime Minister Trudeau in Canada take a decision to restrict access to bank accounts for those involved in, or linked to, the trucker riots. And more recently, global leaders in the west have cut off Russia’s access to their foreign currency reserves held abroad.

The impact of such measures, even if imperceptible at first, is to lessen the value of hard currency. Such moves add legitimacy to crypto enthusiasts (though ultimately, for now, crypto must come back to fiat money) and increases the popularity of money of last resort, gold.

If the implications of Trudeau’s actions on fiat money were imperceptible, the case would be quite different when thinking about the fallout from the Russian sanctions. Russia has amassed a huge foreign currency reserve, in the top 5 largest globally, perhaps in preparation for events such as those unfolding. But much of the $600 billion is held in currency printed by nations which strongly oppose their actions– including the US, EU and UK.

East and West

Cutting access to forex reserves isn’t new – just last year, the US cut Afghanistan’s access to its foreign reserves following the reinstatement of a Taliban leadership – but doing this to a G20 nation risks deepening economic and political fissures between “East” and “West”. Over recent years, Russia has been moving reserves out of USD and into Chinese renminbi and gold. Whichever way this war turns out, it is safe to assume this reallocation speeds up should access to reserves be reinstated.

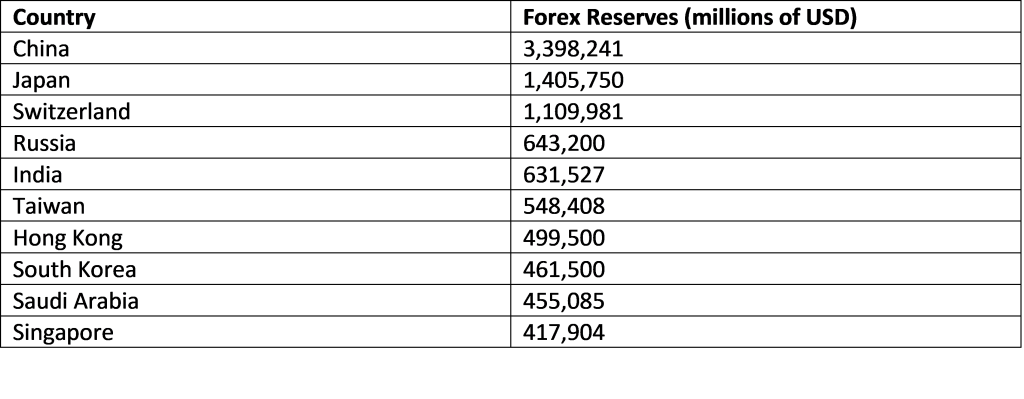

Though the few hundred billion dollars of reserves held by Russia is unlikely to cause a value collapse in any one currency, we ought to consider other nations that are watching intently. If you are a country which is less politically aligned with the US, you will see red flags in the recent moves. Looking at the world’s largest currency reserves, some names stick out as potential sellers of dollars. In the top 10 we have China, Russia, India, and Saudi Arabia – all of which will likely shift some assets from USD to other currencies.

Market Implications

Collectively, the four nations listed above, hold almost $1.4 trillion of US treasuries – should the reallocation happen gradually, then this number isn’t likely to cause too much market disruption. The risk is that post-Ukraine the reallocation isn’t gradual. A sudden sale of this size, into a market where the Fed is actively pulling back from buying debt, could cause shockwaves. A large scale sale of treasuries would push rates higher across the curve, and at worst could force the Fed to step in and regain control – reinforcing the idea that the treasury market is not as robust as required (Perils of Poor Liquidity).

Once the dollars are received for the treasuries, the nations would sell these dollars and move into a new reserve currency/asset – causing weakness in the dollar alongside rising rates. At worst, these rising rates could reverberate across markets – the move higher in rates we have seen in the last six months helped roil equity markets – a faster and larger move, coupled with a shift in the political and economic status quo, could cause an even bigger crash in prices.

The likely winner in this would be the Chinese renminbi – reallocation has already started, and the currency is the obvious candidate to supplant the dollar for those looking to change. This raises the question of what China is to do with its foreign reserves? There are many routes they could go but a couple stick out. They could decide (again, recent events make this more appealing) to build up a war chest of natural resources – hoovering up oil, gas, metals – ensuring access to goods for the foreseeable future. If this were to happen imminently, it would of course exacerbate the issues facing the rest of the world and though higher prices may deter the Chinese, they have got a little over $3 trillion to play with. The other, more trodden path, would be increasing their holding of the world’s original currency, gold.

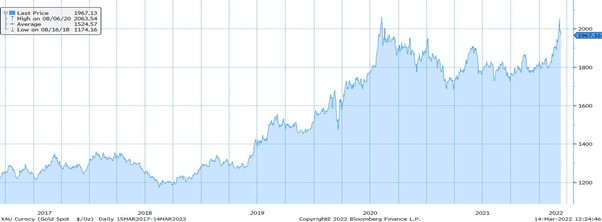

Chart 1 – Recent times of stress have supported the price of gold

Source: Bloomberg

These developments may seem a long way off but as we have learnt over recent weeks, when situations escalate, they can move very rapidly. Whether the developments in Canada see a boom in crypto infrastructure or the sanctions on Russia cause significant shifts in reserve currency of choice – now seems the perfect time to keep in mind the words of J.P. Morgan: “Gold is money, everything else is credit.”

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.