Should he stay or should he go: Market impact if Boris Johnson holds on or resigns as Prime Minister

18 January 2022

Navigating the risk in the age of uncertainty: possible scenarios and implications

1 February 2022INSIGHTS • 25 January 2022

Will the BoE end sterling's party?

Jesús Cabra Guisasola, Senior Associate – Global Capital Markets

"Monetary policy cannot solve supply-side problems - but it will have to act and must do so if we see a risk, particularly to medium-term inflation and to medium-term inflation expectations," – Andrew Bailey During an online panel in October 2021.

“The Bank of England has long stressed that central bank policies are not the cause of low rates, but responses to them. We are actors in a play written by others.” – Mark Carney (Former Governor of the BoE).

This week, we are diving into the monetary policy tightening cycle that the BoE started at the end of 2021 and considering how this could impact sterling in 2022.

Back in September 2021, the outlook for the British economy was far from certain. GDP was growing slower than hoped at 0.5%, inflation had spiked higher at 3.2% and the furlough scheme underpinned the labour market. Consequently, the BoE emphasised the unpredictability of the economy in the coming months and the need to wait for further signs of recovery before it could consider altering its ultra-loose stance on monetary policy.

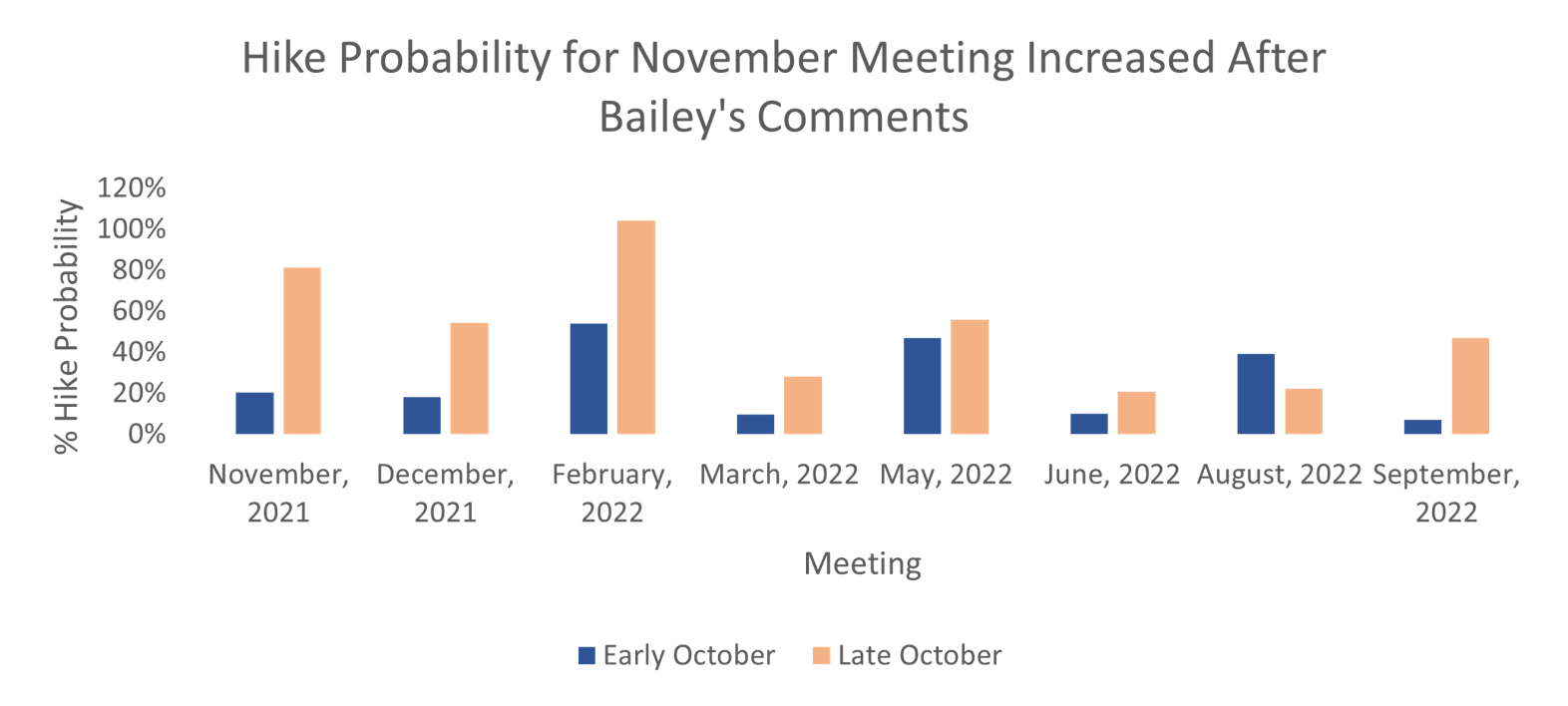

However, in October 2021, Andrew Bailey and other MPC members started changing the narrative, highlighting concerns around the spike in energy prices and the impact on consumer prices. The message from the Governor was that the BoE will have “to act” to mitigate persistent inflationary pressures. These comments were backed up by Michael Saunders and Huw Pill – helping to create some momentum behind market expectations for a first-rate hike at the following meeting in November.

Source: Bloomberg

Nevertheless, when the November meeting came, the MPC surprised the market by leaving rates unchanged at 0.1%. This raised questions among investors over the credibility of the BoE’s rhetoric and the more hawkish messages from committee members in the press, who had been implying faster monetary policy tightening. As a result, markets tentatively started to forecast for a first hike in early 2022 given the outbreak of Omicron and the imposition of new restrictions from the government over the holiday period.

Nonetheless, the BoE surprised once again, and MPC members decided to increase the base rate by 15bps in an 8-1 vote at the December meeting. This caught investors off-guard again and positioned the BoE as the first big central bank, ahead of the Fed and ECB, to start tightening.

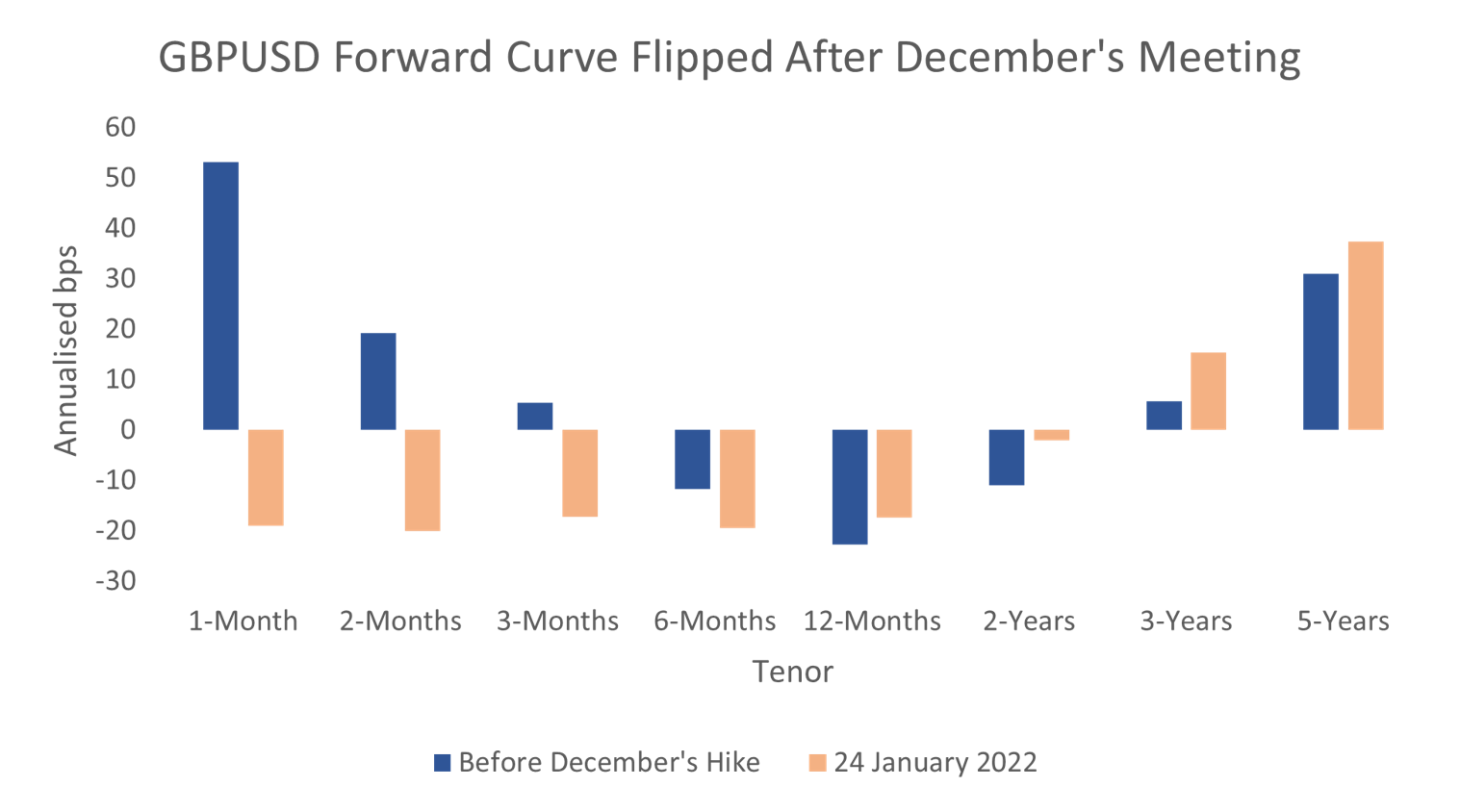

On the back of this decision and the rapid recovery from the latest covid variant, we have witnessed a strong performance from sterling since the beginning of 2022, with the pound rallying against both USD and EUR, to $1.38 and €1.20. Moreover, with the BoE hiking first, the GBP/USD forward curve flipped to negative carry for Dollar denominated investors hedging sterling assets up to 2-years forward.

Source: Bloomberg

*Impact to sell GBP forward, positive number indicates positive carry.

The case for another hike at the February meeting next week has strengthened in recent days, with the consumer price index rising to its highest level since 1992 (5.4%) in December. Furthermore, policy maker, Catherine Mann, commented last Friday that she is prepared to vote for another rate increase as inflation could remain “strong for longer”. Meanwhile unemployment continues to fall (currently 4.1%) and rising wages suggest a risk of further upward pressure on prices from rising demand.

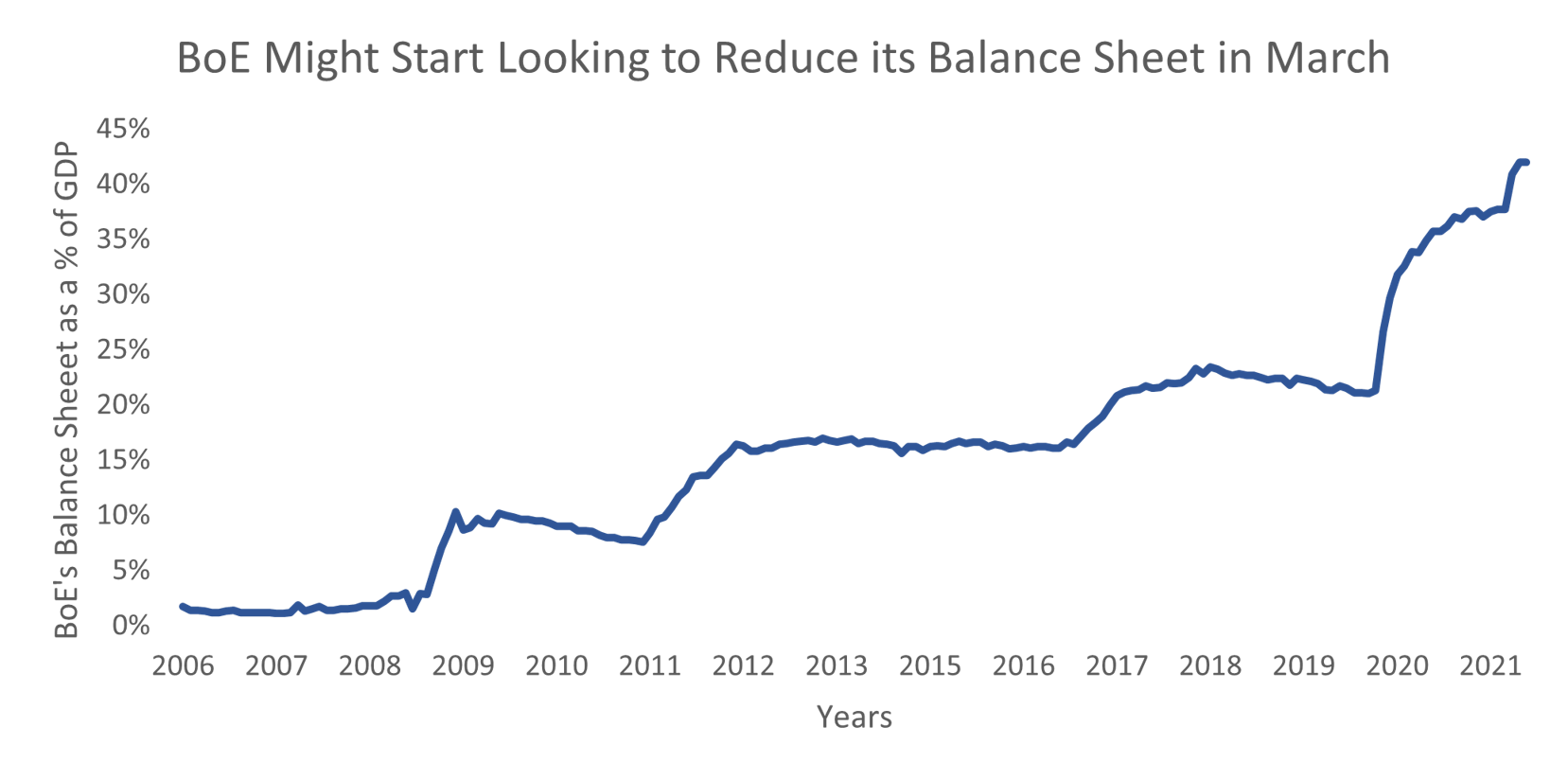

If the BoE decides to pull the trigger and increase rates to 0.5%, it would be the first back-to-back hike since 2004. It will also open the door for the central bank to start reducing its balance sheet, which in turn risks higher longer-term rates given that the biggest buyer in the market will not be reinvesting bonds maturing in March (c. £28bn).

Source: Bloomberg

With the hike in February already fully priced in, what’s next and how many rate hikes we should expect in 2022?

Market participants are forecasting interest rates at 1% by August 2022 and 1.25% by the end of 2022.

Given the fragility UK economy, the main reason for faster interest rate hikes comes from persistent inflationary pressures. Such data could force the BoE to outstrip market expectations and hike faster than expected. Nonetheless, the central bank has limited tools to control a problem that is primarily the result of external factors such as higher energy prices and bottlenecks in the supply chain.

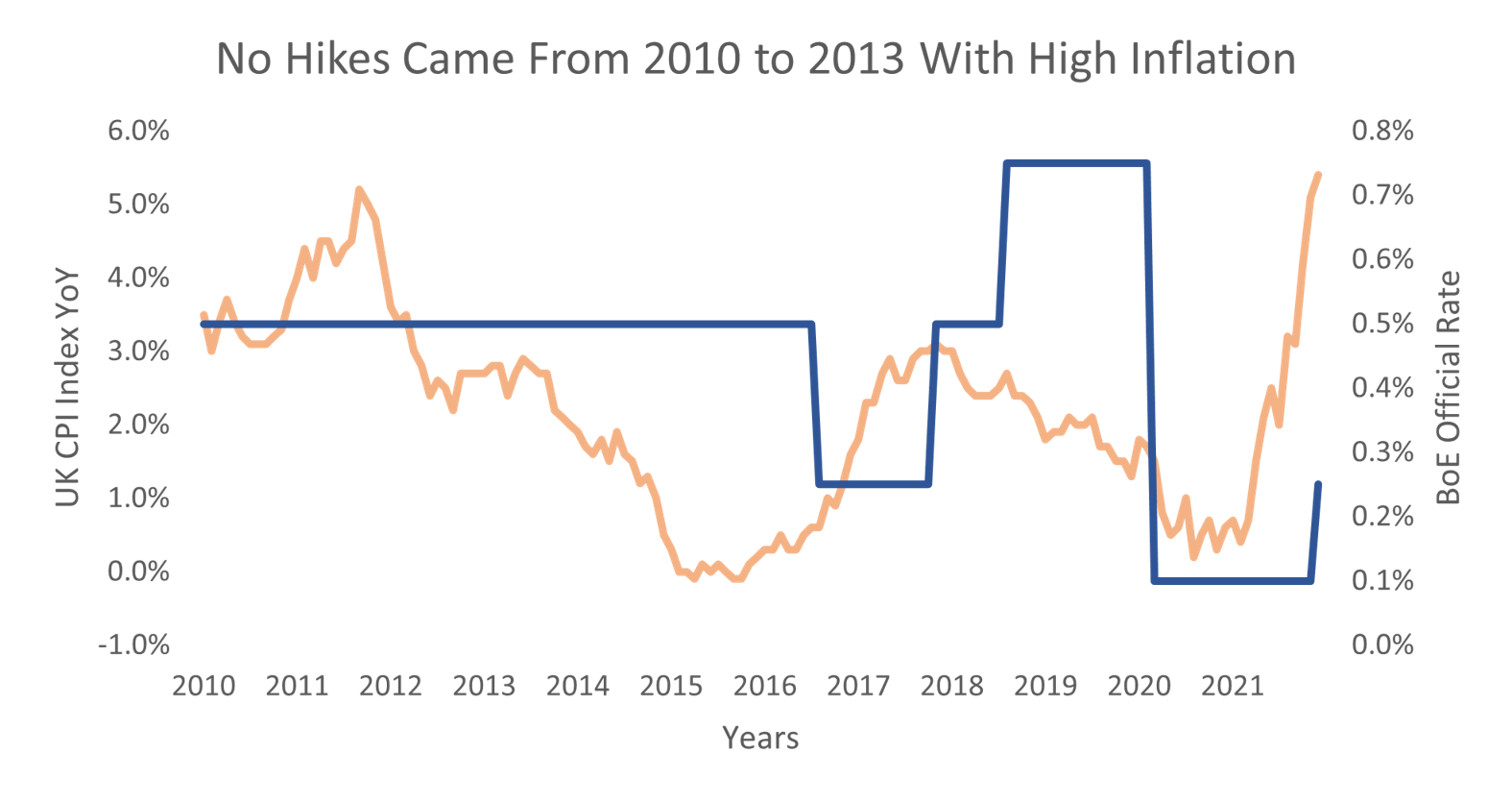

In our view, the market may be getting a little ahead of itself pricing in 4 rates hikes for 2022 – the BoE has form in not “wanting” to hike. Inflation was above target continuously from 2010 to 2013, yet the committee kept rates unchanged. If the MPC disappoints markets and sits on their hands as they did in the early 2010s, the pound would likely come under heavy pressure after a good start of the year.

Source: Bloomberg

As such, we remain cautious around sterling in the coming months against both the dollar and the euro. When coupled with uncertainty surrounding the Tory government and the global nervousness surrounding Russia (sterling has historically performed badly in a risk off environment) we see a risk of sterling running into significant headwinds throughout 2022.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.