Validus appoints COO and New York Principal to support global growth

17 November 2021

Market gears up for policy meetings as Fed changes narrative

7 December 2021INSIGHTS • 30 November 2021

The Perils of Poor Liquidity

Shane O'Neil, Head of Interest Rate Trading

Much has been made of the recent increase in market volatility, central bank upsets and economic surprises have left the market increasingly unsure of the path of asset prices in the immediate future. But one, somewhat hidden, factor is exacerbating moves – dwindling liquidity.

Treasury markets not immune

The US Treasury market, the buying and selling of US government-issued debt, is the most liquid in the world, and yet even this market has felt the sting of worsening liquidity. Uncertain markets create unsure traders which, in turn, worsens liquidity – traders being the main source of liquidity provision will at best charge more for each trade and, at worst, completely stop providing tradeable prices.

One measure of liquidity in Treasury markets is the difference in yield between adjacently issued Treasuries – in liquid markets the yields converge as time goes on, as the assets are very similar, but in times of stress and illiquidity the differences grow and can stay this way until liquidity returns (just ask the founders of LTCM). Looking at the yield differential between the 10-yeaT treasury issued in May and the next issuance in August, we can see that shortly after issuance the difference was about 1.7bps but this widened, increasing to almost 3bps in early November when market liquidity was most sketchy, and remaining near this level today.

The issue is confirmed by the Bloomberg liquidity index and BofA MOVE index, which measure Treasury market liquidity and volatility respectively. Both point towards trading conditions being the most difficult since the onset of the pandemic in early 2020.

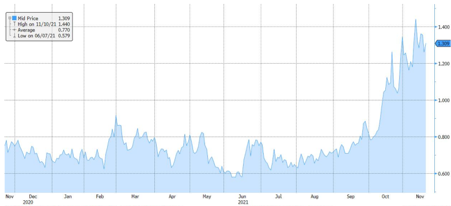

Chart 1: Bloomberry Treasury liquidity index pointing toward worsening trading conditions

Source: Bloomberg

Hedge funds feel the heat

There are many reasons for the worsening liquidity, but one pertinent factor has sprung from the often-secretive world of macro hedge funds. These funds put on huge trading positions and benefit when macro factors, such as interest rates, move in their favour – but this year has been tough. Across the board the biggest names in the industry have been losing money and cutting positions, and it is this position cutting which saps liquidity.

Banks across the street have bemoaned the negative effects of such position unwinds – as markets began to go against hedge funds it became clear that many speculators were positioned in the same way, and everyone wanted out at the same time. This exacerbated market moves and passed the losing positions to banks who then had to try and unwind it themselves without losing more money – some managed to, but others did not.

With funds, themselves a source of market liquidity, shutting down for the year, and banks trying to unwind large, inherited positions or nursing trading losses – the appetite to show prices to risk managers (or anyone else) dwindled. The issues aren’t isolated to USD instruments – GBP interest rate markets have experienced similar, if not worse, issues.

Markets feel the squeeze globally

During late October the GBP swaps curve flattened aggressively, for many of the reasons detailed above – but liquidity in GBP is already a fraction of that in USD markets, and so the effects were more debilitating for the market. Market participants commented that during the worst of the moves daily notional traded between banks fell to tens of millions where in normal conditions it would be hundreds at a minimum, and this gets to the crux of the issue for us as risk managers.

As sometime users of macro markets (rates, FX), it can be easy to assume that when a hedge needs to be done, one can simply do it – this isn’t always the case. We have also seen the effects here at Validus – one example comes from the euro market, when we requested pricing for a routine EUR interest rate structure, an incredibly liquid and well-banked market in normal times, and a large European bank refused to price – citing market upheaval and inability to price it accurately.

There are numerous reasons for market liquidity to remain fragile over the next year – changes in asset supplies including global QE tapering, lower government issuances – particularly in the UK, and continued market uncertainty around Covid-19 and inflation. As a risk it is almost impossible to manage directly – but having a hedging program in place can allow risk managers to act quickly and before price moves force their hand. Market conditions have changed significantly since the onset of Covid-19, with the re-emergence of risks which have laid dormant for almost a decade – it’s time to add liquidity to the list.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.