Stimulus on stimulus: how will the US infrastructure bill impact markets?

17 August 2021

Two and a Half Centuries of (Real) Interest Rates

31 August 2021INSIGHT • 24 August 2021

Fed Tapering: Uncertainty and Unforeseen Consequences

Shane O’Neill, Head of Interest Rate Trading

One thing a person cannot do, no matter how rigorous or heroic their imagination, is make a list of things that would never occur to them.” - Thomas Schelling

Over recent weeks, market debate has been increasingly focused on the topic of Fed tapering – with the economy making progress and inflation (transitory or not) well above Fed targets, it will be difficult to kick the can down the road any further. The next event taking center stage is the Jackson Hole Symposium, where Fed Chairman Jerome Powell will speak on Friday. Market expectations are for tapering details to be laid out and for the process to begin late this year or early next. So, with tapering around the corner, what better time to look at past mistakes, lessons and whether this time will be different.

Mistakes of the past

The phrase “tapering” entered the market’s vocabulary in late May 2013, when (then) Chairman Ben Bernanke signalled that the Fed was considering slowing the monthly treasury purchases from $85bio/month, when speaking in front of Congress. The market was not prepared – years of easy money had seen equities rise, rates fall, and tight trading ranges become the norm in many asset classes.

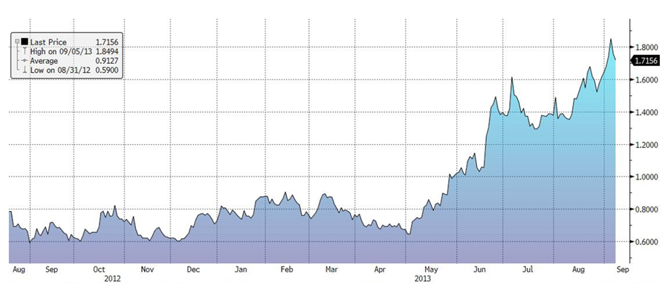

There was unquestionably a case of misinterpretation – tapering had been conflated with tightening, market participants saw a slowing of purchases and immediately jumped to hikes and balance sheet reduction. This was not the case, but Bernanke’s haphazard communication meant the horse had bolted. Interest rates shot higher - the yield on 5y treasuries, which had been in a 25bps range for the year before Bernanke’s comments, gained 100bps in a little over 3 months.

Chart 1: Yield on 5y Treasury Debt

Source: Bloomberg

Though this was a US story, contagion was fast – yields in Europe and the UK followed suit and jumped higher. Bank traders were rattled, and the effects were felt by hedgers across the world. Huge increases in fixed rates were compounded by poor liquidity and high volatility, meaning the cost of hedging was as high as it had been since the 2008 crash.

A precedent was set, tapering was a difficult and delicate process. Lessons of communication were certainly learnt, and these lessons are evident to this day – the current Fed may not be sure of all the exact details of the next taper, but they are very clear that tapering is not tightening, and rate hikes are some way off.

There is, however, no avoiding the fact that after the taper comes tightening, and events from 2019 show that this too is a difficult and a hard to predict process.

Also, hedgers also have an incredible opportunity to take risk off the table with minimal associated costs. Medium term rates and interest rate volatility are close to multi-year lows, while the initial cost-of-carry on medium-term swaps is below its long-term average. It is seldom that the market presents such opportunities to hedge so cheaply, especially given the volatile backdrop. Wait-and-see hedgers in 2013 had many regrets, so if there is debt to be fixed, now feels like a sensible time to take that uncertainty off the table – there is more than enough uncertainty to replace it.Will this time be different?

Some market commentators are convinced that taper related tantrums are a thing of the past – improved communications and past experiences will guide the way. But can hedgers take such a risk?

The Federal Reserve is constructed in a way that demands rigour of thought – debate follows debate before any action is taken – and this is not a recent development. And yet, in 2013, they miscalculated and caused significant and costly market shocks. Despite this lesson, the shocks did not end - unforeseen political developments coincided with decade old regulation to create a perfect storm that seized up money markets in 2019.

We are living through a period of increasing geopolitical uncertainty, with scenes in Afghanistan mirroring those in Vietnam many decades ago, and Chinese and Russian influence gaining ground on traditional political powers. A global pandemic, the likes of which we have never seen, has caused unprecedented economic headwinds. US Inflation is back above levels not seen since the early 1990s and years of easy money have equities producing record highs every day. And in this setting, the markets are trusting the Fed to achieve a goal it has proven itself incapable of twice in recent memory.

The markets may be better prepared this time, as there may be no hidden effects waiting to spook us, but the risk seems skewed. The best a borrower can hope for is a calm market. There are few arguments that tapering will directly lead to lower rates, and the worst-case scenario is a repeat of 2013 or 2019.

Hedgers negatively exposed to higher rates should be cautious about this market complacency, with upcoming fed action likely to move rates higher over the next 6-to-12-months.

Also, hedgers also have an incredible opportunity to take risk off the table with minimal associated costs. Medium term rates and interest rate volatility are close to multi-year lows, while the initial cost-of-carry on medium-term swaps is below its long-term average. It is seldom that the market presents such opportunities to hedge so cheaply, especially given the volatile backdrop. Wait-and-see hedgers in 2013 had many regrets, so if there is debt to be fixed, now feels like a sensible time to take that uncertainty off the table – there is more than enough uncertainty to replace it.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.