Not out of the woods: Covid risk subsides but the foundations of a ‘market melt-up’ scenario remain

4 April 2021

Loonie in the Spotlight

13 April 2021INSIGHTS • 6 April 2021

Beware The Right Tail

Kambiz Kazemi, Chief Investment Officer

One of the key elements of prudent risk management is the need for a framework that can define ranges for the future price returns of assets. It is therefore no surprise that statistical distributions and probabilities are at the very heart of risk management.

Tail risk refers to “the chance of a loss occurring due to a rare event, as predicted by a probability distribution”. While tail risk technically refers to both the left and right tails, most investors associate the notion of risk mainly to that of losses (i.e the left). The infamous left tail and “extreme” left tail (i.e. Black Swans) have kept many risk managers awake at night, and have been the subject of unending studies and analysis for many decades.

Yet risk is not all about drawdowns and losses. It is important to remember that the right tail (i.e. abrupt moves higher) also encompasses investment risk. A simple example is an investor who is underinvested in a market that “gaps up”. When it comes to investing, not missing opportunities can be just as important as avoiding disaster.

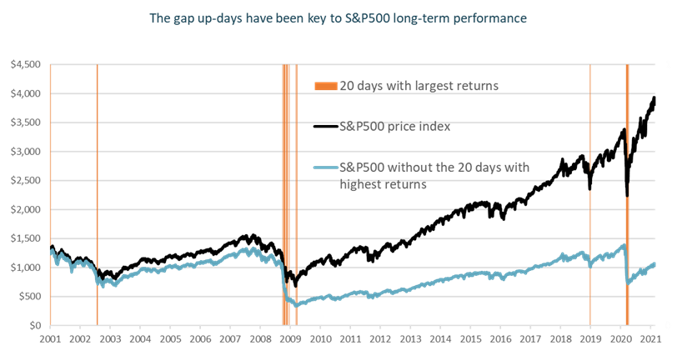

Chart 1 shows how an investor with exposure to the S&P 500, who has missed the 20 days with the highest returns for the index since January 2001, would have achieved a near zero return on their investment over the last two decades.

This example highlights how important it is to be aware of the risk of the right tail.

Chart 1: S&P500 Right Tails

Source: Bloomberg

In our March 9th, 2021 note: “A Beautiful (rate) Rise”, we concluded that an orderly and contained rise in long term US interest rates would “be very supportive for risk assets across the board and see them rise in unison”, while assigning a 60-70% probability for this scenario.

Since then, the 10-year US treasury yield has risen to ~1.70%, at a reduced pace and in an orderly fashion.

Chart 2: 10-year Treasury rates

Source: Bloomberg

In addition to this seemingly benign rise in interest rates, we observe several developments with regards to the economic recovery, which along with some risk metrics we follow closely, are constructive and add to the likelihood of a “risk-on” scenario. To be clear, we are projecting a strong short-term rally as a central scenario, but we see compelling forces at work that could lead to such an accelerated rally (of US equity markets in particular). This in turn will force those who are underinvested to chase the rally, reinforcing a potential and temporary positive feedback loop.

The US recovery is coming to life

The latest economic data coming out of the US has been generally positive and, in many instances, has exceeded average estimates. In particular, the latest PMI and payroll data surprised to the upside. The market sees the main drivers of the recovery theme as being:

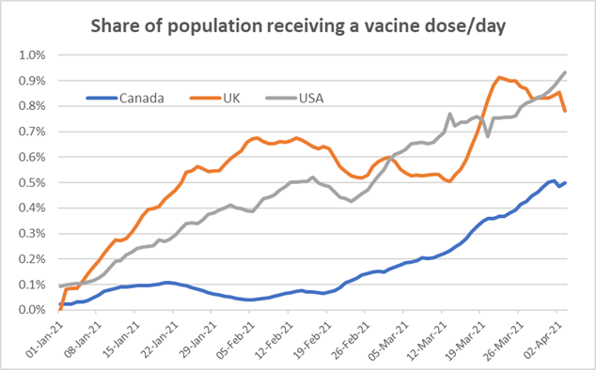

Both these drivers seem to be alive and kicking. Vaccination campaigns are progressing well and their continued acceleration in many developed markets (see Chart 3) points to the end of Spring and early Summer as the time when critical thresholds needed for slowing the spread of Covid-19 may be reached.

Chart 3: Vaccination campaigns progressing at a healthy (accelerated) rate

Source: ourworlindata.org, Validus RM

Most interestingly, the US consumer seems to be fully embracing and even driving the recovery theme – albeit perhaps prematurely from a healthcare perspective. The fact that areas of the economy that were the hardest hit by the pandemic are seeing a tremendous pick-up is a strong sign of the (pleasant) surprises that might be ahead of us.

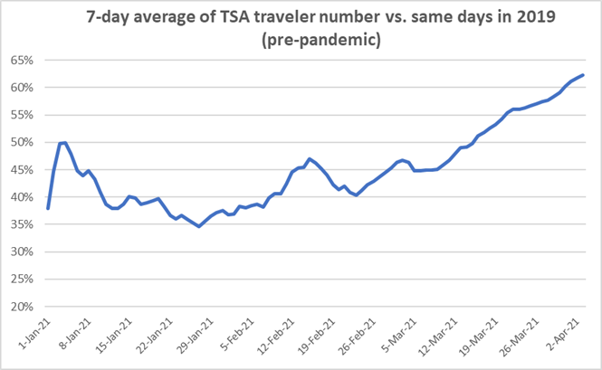

Air travel has doubled since early 2021 to 65% of its pre-pandemic level at the same period (compared to 2019 as a pre-pandemic benchmark). Considering that the pre-pandemic data includes international travelers, domestic travel could be already at over 80% of its pre-pandemic level, by our estimate.Chart 4: TSA traveler number

Source: TSA, Validus RM

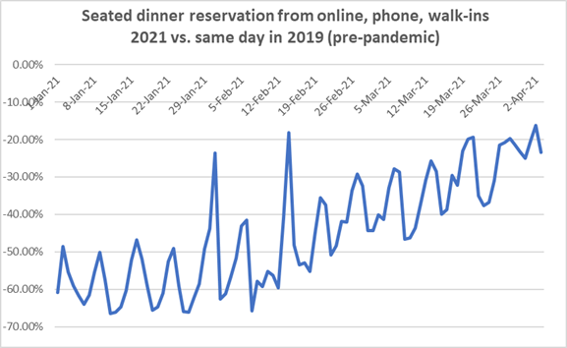

Restaurant dining in the US, as reported by OpenTable, is now only 20% below pre-pandemic levels compared to 60% at the start of 2021. An impressive pick-up for a sector that has been suffering tremendously over the last year.

Chart 5: Seated dinner reservations

Source: Opentable.com

These are some anecdotal signs of the potential forces that can be unleashed when (and if) the pandemic dangers are more muted and further controlled in a few months’ time, barring unforeseen complications due to new variants.

It is therefore not surprising for us to see risk pricing (i.e. option prices) having shifted lower in the last few weeks.

Volatility & options price compression

On Thursday April 1st, the VIX closed below 18 for the 1st time since the start of the pandemic, reaching its lowest level since Feb 21st, 2020. While we do not see the VIX alone as an indicator of volatility risk premium (as it is a short-dated measure that only represents an expected 30-day volatility), what is noteworthy in the last two weeks is the breakdown of option prices across all maturities to levels not seen since the start of the pandemic.

Chart 6: S&P500 2-year at-the-money implied volatility: a new regime?

Source: Bloomberg

S&P500 2-year implied volatility fell below 20% for the first time since the start of the pandemic.

This means that while equity (and some other assets) prices have been increasing since the pandemic, market expectations of the risks ahead have stayed unchanged since last summer. However, those expectations are finally now shifting down.

Historically, this type of abrupt downward readjustment after a prolonged period (which has marked a new floor for risk pricing), can lead to a “volatility reset”. In other words, there may be a dawn of a ‘new volatility regime’, where expected futures risks are marked down by market participants as they see brighter prospects ahead.

Options prices for other equity indices, both in the US (Nasdaq and Russell 2000) as well as in Europe (FTSE100, DAX or CAC40), exhibit the same downward adjustment and are breaking the “risk floor” established since the pandemic. Risk pricing for precious metals has also softened, while currency option premia have been consistently drifting down since the summer of 2020. The change in risk sentiment seems to be cross-asset.

Conclusion

Many challenges and uncertainties lay ahead of us before a clear post-pandemic picture of the world emerges. While vaccination campaigns in some developing countries are impressive, uncertainty about the appearance and spread of new variants remains a major risk to the resolution of the pandemic.

Additionally, many countries have not yet been able to undertake vaccination campaigns and will face many challenges that will inevitably affect the global economic landscape, including developed markets.

Yet, it seems clearer each passing day that a de-synchronized global pick-up in economic activity in the short-term may be upon us. In particular, the US and UK could soon join the ongoing uptrend of some Asian economies. Policymakers have also clearly signaled that they intend to further support the burgeoning recovery.

But it also seems a year of multiple pandemic waves has disrupted personal lives, routine, and businesses alike, which coupled with the never-ending pushback of the expected timelines for a “back to normal” has profoundly eroded general optimism and psyche. What if in the short-term the recovery was to surprise those investors who are increasingly cautious after one of the most impressive post-crisis rallies?

At this juncture, we believe it would be wise for any investor to incorporate such an outcome – a right tail surprise - into their analysis and portfolio construction. Given the recent cheapening of option premia, these instruments can offer value in addressing both risk as well as generating potential upside.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.